Top Venture Capitalists in the United States

Behind some of the most successful U.S. companies—think Google, Airbnb, or Stripe—stand visionary venture capitalists. These investors do more than just write checks; they help shape ideas into companies that transform how we live and work. In 2022 alone, U.S. venture capitalists poured over $238 billion into startups, making the United States the global leader in VC funding.1

But who are the people and firms driving this innovation? What sets the top venture capitalists apart, and why do founders work so hard to get their attention? In this guide, we’ll explore the leading names in American venture capital, the ways they influence emerging industries, and how their bets ripple through the entire economy. Whether you’re a founder searching for your first investor or just curious about the people who spot tomorrow’s trends today, understanding top venture capitalists is a window into the future of business itself.

1Source: PitchBook-NVCA Venture Monitor, 2022

What Sets the Leading U.S. Venture Capitalists Apart?

Investment Philosophy and Approach

The most sought-after VCs don’t just chase market trends—they develop a knack for recognizing ideas that fundamentally reshape industries. Instead of fixating on instant returns, they dive deep with founders, commit to moonshot visions, and calibrate risk with patience. Many top investors, like those at Sequoia or a16z, spend months cultivating relationships before a deal, often working as sounding boards for founders before a single term sheet is presented.

What truly distinguishes them is their hands-on involvement. They roll up their sleeves, offering strategic tough love and helping startups dodge common pitfalls. Their conviction can sometimes seem contrarian at first; after all, the biggest returns are rarely made on consensus bets.

Notable Portfolio Companies

Scan through the track records of renowned VCs and you’ll find the earliest checks in the likes of Airbnb, Stripe, Uber, and Instacart. The top venture capitalists tend to spot disruptors years before the mainstream even notices. Their portfolios read like a who’s who of industry-defining startups—their fingerprints are visible across today’s unicorn landscape. This ability to consistently back breakout companies, even across different sectors, is a clear sign of their discernment and adaptability.

Influence on Startup Culture

Leading U.S. VCs shape more than just finances—they leave a mark on startup DNA itself. Legendary VCs normalize practices like “founder-first” governance and encourage gritty, iterative experimentation over rigid business plans. In boardrooms, their presence brings candor, urgency, and clarity. Many also advocate for diversity in hiring and provide their network to catalyze business development, hiring, or follow-on capital. Their involvement often leaves a lasting imprint on how founders build, scale, and sustain companies.

Understanding what makes these investors remarkable also reveals broader patterns—both in the faces behind the firms and the sectors seeing transformational growth. Next, we’ll spotlight the specific firms and individuals currently shaping the American venture capital landscape.

Who Are the Top Venture Capitalists and Firms in the U.S. Right Now?

Andreessen Horowitz (a16z)

Founded in Silicon Valley in 2009 by Marc Andreessen and Ben Horowitz, a16z has disrupted the way venture works by building an investment team that blends technical operators, subject-matter experts, and marketing pros. They’ve backed icons like Airbnb, Coinbase, Stripe, and Clubhouse, and recently upped the ante in everything from crypto to biotech. Their ability to predict shifts (think: Web3) keeps them at the center of every hot deal.

Sequoia Capital

Sequoia’s fingerprints are on Apple, Google, Instagram, and Zoom. This storied firm doesn’t just invest early—they often help shape entire industries. Their methodical process for spotting and nurturing outlier founders has made Sequoia nearly synonymous with breakthrough innovation.

Tiger Global Management

Tiger Global put the “blitz” in blitzscaling. Aggressively leading mega-rounds and backing hundreds of startups annually, their data-driven, global-first strategy injects capital at warp speed. DoorDash, Stripe, and Databricks have all benefited from Tiger’s high-velocity, high-conviction approach.

Kleiner Perkins

Kleiner Perkins helped birth Silicon Valley’s venture scene and has remained relevant for decades. From Genentech and Google to Figma and Amazon, their investments span fields from enterprise software to climate tech. The firm’s knack for reinventing itself is nearly as impressive as its track record.

Bessemer Venture Partners

With roots tracing back to the 1910s, Bessemer is one of the oldest and most consistently successful venture shops. They’re known for comprehensive “anti-portfolios” revealing all the unicorns they missed—underscoring their humble, transparent vibe. They’re behind Shopify, LinkedIn, Toast, and Twilio, with a reputation for deep dives before investing.

Accel

Accel defines global reach and early-stage excellence. The firm’s growth-stage bets, especially on Facebook, Dropbox, and Slack, continue to pay off big. Accel blends hands-on guidance for founders with a pulse on emerging global tech hubs.

Benchmark

Benchmark champions an intentionally small partnership model, fostering bold decision-making and deep founder trust. They wrote the early checks for Uber, eBay, and Instagram. Their high-conviction, founder-friendly style—no management fees or solo partners—makes them a favorite for serial entrepreneurs.

Lightspeed Venture Partners

Lightspeed built its reputation in enterprise SaaS but found massive wins in consumer tech like Snap, Affirm, and Outbrain. Their early commitment to female founders (such as backing Girlboss) signals meaningful shifts in who gets funded.

General Catalyst

General Catalyst specializes in guiding startups from seed all the way through IPO. Their supportive, product-oriented philosophy led to successes including Warby Parker, Stripe, and Gusto. The firm’s coast-to-coast presence positions it well to capture top deals beyond just Silicon Valley.

Noteworthy Individual VCs: Bill Gurley, Aileen Lee, Peter Thiel, and Others

Certain individuals stand out for their instincts and outsized influence. Bill Gurley of Benchmark shaped Uber’s rise and remains an outspoken industry voice. Aileen Lee is known for coining “unicorn” and investing in Bumble and TheBoardlist via Cowboy Ventures. Peter Thiel, legendary for PayPal and Palantir, backs contrarians and game-changers through Founders Fund. Many other solo capitalists are leveraging their brands to spot—and win—iconic deals.

Now that we’ve met the top firms and individuals powering innovation, let’s dig into how they are shaping the most crucial sectors of the American economy—and what that means for founders and investors navigating a rapidly evolving landscape.

How Top Venture Capitalists Impact Key Sectors

Tech and SaaS

Venture capitalists fuel the relentless pace of innovation in technology and software-as-a-service (SaaS). Their backing lets ambitious founders experiment with new architectures, rapid software deployment, and scalable cloud solutions. From funding the earliest days of GitHub to fueling the ascent of Salesforce and Slack, these investors have shaped how people work, code, and communicate. Their involvement often extends beyond capital, introducing critical connections to engineers, early adopters, and future acquisition partners.

Fintech

In financial technology, top VCs hunt for startups redefining money movement, digital banking, and investment apps. Backed by bold investors, companies like Stripe and Plaid have rewritten the rails of commerce, beating legacy systems with faster, smarter solutions. Venture capitalists here have a sharp eye for both regulatory trends and user experience, pushing founders to blend compliance with frictionless onboarding, leading to fintech tools millions now use daily.

Healthcare & Biotech

Few sectors require as much patience—and vision—as healthcare and biotech. Investors put capital into companies targeting next-generation diagnostics, personalized medicine, and digital health records. From early funding for genomics startups to supporting platforms that powered mRNA vaccines, their influence accelerates breakthroughs that can shift entire industries. Beyond funding, many VCs in this space provide access to clinical advisors and guide companies through a maze of regulatory checkpoints. For more insights, explore our healthcare venture capital firms post.

Consumer & Market Trends

Consumer-facing innovation continually draws leading investors who sense shifts in shopping, media, and lifestyle habits. Their bets have launched iconic brands in mobility, food delivery, and e-commerce—think of early investments behind Airbnb, DoorDash, and Peloton. With unique market insight, VCs spot trends before they spike, helping founders capture new consumer tastes and behaviors just as they’re emerging.

No matter the sector, top venture capitalists thrive on spotting what’s next. Their insight and risk tolerance not only fuel legendary startups—they also offer a blueprint for others wanting to work with leading investors. If you’re hoping to land on their radar, understanding how they operate is a crucial first step.

Thank you for reading EasyVC’s blog!

Are you looking for investors for your startup?

Try EasyVC for free and automate your investor outreach through portfolio founders!

Ready to identify the best VC partner for your next big idea? This is the perfect moment to take action and start making strategic connections. Whether you’re an entrepreneur seeking funding or just curious about the minds shaping tomorrow’s industries, the next steps could change everything.

Eager to learn how to break through and get noticed by the investors on this list? Let’s explore the smartest ways to get on their radar in our fundraising tips guide.

[CTA-HOOK]How to Connect with U.S. Venture Capitalists

Best Ways to Get Noticed

Venture capitalists see hundreds of proposals every month—so standing out requires more than just an email introduction. Warm introductions from trusted founders, investors, or ecosystem insiders can make a big difference. Attending targeted startup events, demo days, and pitch competitions is another genuine way to build rapport before ever sending a deck. VCs also pay attention to active voices on industry-specific and founder communities, so sharing insights, progress updates, or helpful resources in those spaces often opens doors organically. Check out our guide on warm intros startup funding to understand how to leverage introductions effectively.

Crafting Your Pitch

Crafting a pitch for U.S. investors means getting straight to the point: What unique problem are you solving, and why now? Avoid jargon or grand promises—clarity is king. Nail your market size, solution, business model, and defensibility using concise language. Authentic founder stories matter, as do clear milestones already reached.

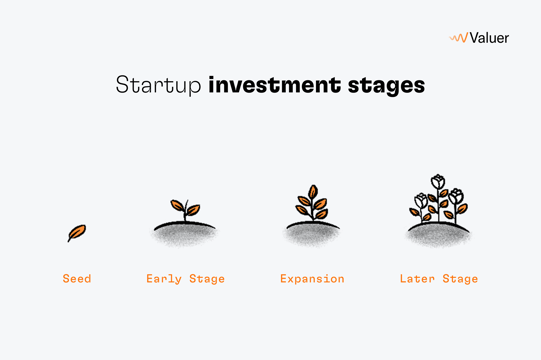

Understanding where your company fits in the funding landscape also helps tailor your approach. Early-stage VCs want to see potential and nimbleness, while later-stage investors expect proof of traction and a path to scale. Visuals like the one above are popular in decks to help illustrate your journey and anticipated growth. For a detailed approach, consider reading our venture capital fundraising deck and go to market strategy pitch deck guides.

Common Mistakes to Avoid

Don’t mass-email the same pitch to every investor. VCs notice cut-and-paste introductions and usually skip them. Generic or exaggerated claims, unproven market assumptions, and technical features without real-world context are easy red flags. If you can’t answer questions about your users or address tough competition honestly, it suggests shallow preparation. And finally—skipping the story behind your team and your motivation is a missed chance to create a real connection.

Once you’ve mastered connecting and pitching, it’s time to navigate the unique details of the U.S. venture fundraising process—everything from funding mechanics to regional quirks and frequently asked questions.

FAQs About Venture Capital in the United States

How Does Venture Capital Work in the U.S.?

Venture capital firms in the United States pool money from investors and use it to fund innovative startups or high-potential private companies. In exchange for capital, VCs receive equity—an ownership stake in those startups. Most venture firms go beyond money, also advising founders, opening doors to networks, and even helping hire new executives. When a startup succeeds, such as through an IPO or acquisition, the VC and its investors profit from the sale of those shares.

What Are the Main Stages of Venture Funding?

Venture capital is usually provided in stages, matching a company’s growth. Funding often begins with seed rounds for early proof-of-concept, then moves to Series A, B, and C as a company scales up. Each stage comes with increasing funding amounts and stakes, and investors often evaluate traction, market fit, team strength, and growth metrics before jumping in. Later-stage rounds typically target companies with proven business models and clear paths to profitability—or acquisition.

Is Geography Still a Factor in Raising VC Funding?

Historically, proximity to venture hubs like Silicon Valley, New York, or Boston helped founders get noticed. That’s changing—thanks to remote work, founders now attract VC interest from anywhere in the country, and some firms actively seek opportunities outside of traditional tech hotspots. Even so, access to strong local networks, experienced advisors, and investor meetups in major cities can still give startups an early edge.

Armed with answers to these FAQs, let’s look at what new ideas and challenges are shaping the landscape for U.S. venture capitalists this year.

Upcoming Trends and the Future for U.S. Venture Capital

Rise of AI and Emerging Tech

U.S. venture capital is obsessed with the transformative power of generative AI, automation, and advanced computing. Startups building with new AI models are raising jaw-dropping rounds, often at breakneck speed. From foundation model builders to narrow, industry-specific applications—think legal, healthcare, or engineering copilots—VCs are scouring every vertical. Quantum computing, climate tech, and robotics are also gaining traction, offering returns beyond traditional SaaS bets. The competitive tempo means venture capitalists move quickly, often backing bold technical founders before products even launch.

Diversity and Inclusion in Venture Capital

The spotlight on who gets funded continues to loom large. More funds now prioritize supporting diverse founders and invest in previously overlooked communities. Limited partners and founders alike are scrutinizing firm demographics and demanding transparency. Initiatives to boost representation amongst decision-makers at VC firms are ramping up, creating ripple effects throughout the startup landscape. The push isn’t just about equity—it’s producing fresh ideas and unlocking untapped markets.

As these powerful shifts gain momentum, understanding how to make connections and stand out in the crowded U.S. venture landscape has never been more crucial. Let’s look at strategies that help founders build those key relationships and nail their next pitch.