How Venture Capital Works

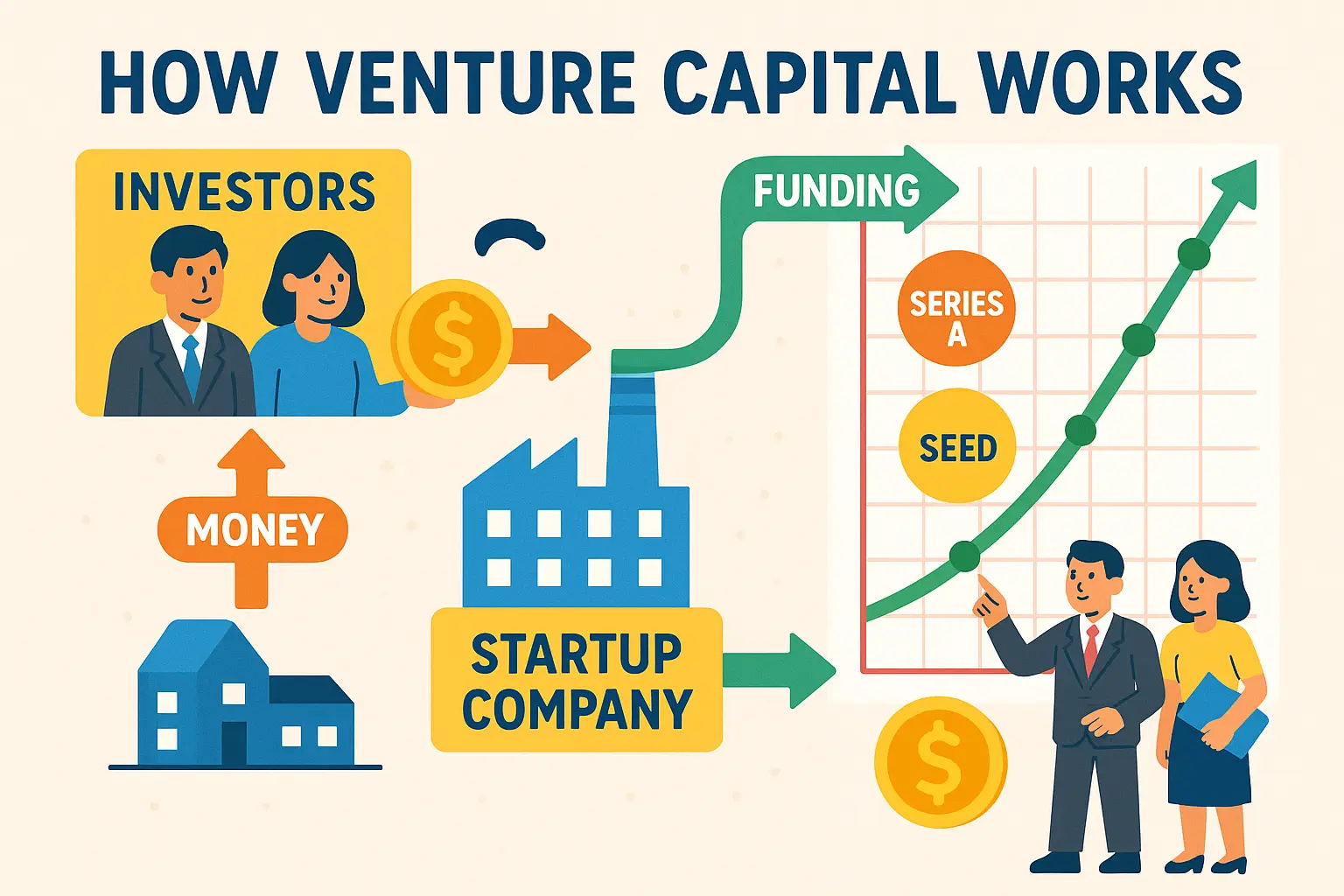

Venture capital is a powerful force behind some of the world’s most successful startups, from tech giants like Google and Airbnb to younger companies that are changing the way we live and work. But what actually happens behind the scenes when a startup gets venture funding?

Globally, venture capitalists invested over $445 billion in startups in 2022 alone, helping founders turn big ideas into reality. For every headline-making success, though, there are countless companies navigating the complex decisions, negotiations, and partnerships that come with venture capital. Maybe you’re a founder thinking about raising funds, working at a startup, or just curious how unicorns come to life. Understanding how venture capital works—who’s involved, how investments are made, and what it means for startups—can make this landscape a lot less mysterious. Let’s break down the basics together.

What Is Venture Capital?

Venture capital is money invested in young, high-growth companies with the potential to reshape industries, but which are usually too risky to attract traditional bank loans or public investors. Rather than handing out loans, venture capitalists buy a piece of the company itself, hoping that a few successes will far outweigh the many failures.

Differences from Angel Investment and Private Equity

Angel investors are typically individuals who invest their own money in startups at a very early stage—sometimes when a company is barely more than an idea. Venture capital, by contrast, comes from funds managed by professionals, which pool capital from many sources. Venture capital tends to get involved once a startup shows initial traction and needs substantial resources to grow quickly. While private equity also means buying ownership in companies, those deals usually target mature firms and focus on restructuring or improving efficiency, not supporting early-stage growth.

Why Startups Seek VC Funding

For startups with bold ambitions—like building the next tech platform or a revolutionary medicine—venture capital offers a way to move fast and scale up. Founders turn to VCs not just for cash, but also for credibility, guidance, and a network of connections that can open doors. However, this support comes with strings attached: giving up equity and a say in how the company is run.

Understanding the nuts and bolts of how these investments really work is the next step toward deciding if venture capital is the right path for founders and investors alike.

Venture Capital Structure and Key Players

How Venture Funds Are Raised and Organized

Venture capital funds begin with a small group of professionals—usually former founders, operators, or investors—who set out to raise a pool of money. Rather than investing their own cash, these managers gather capital from outside investors. The fund itself is typically structured as a limited partnership, where the managers serve as general partners. They pursue commitments from institutions like university endowments, pension funds, family offices, and sometimes wealthy individuals. Most funds have a fixed lifespan—usually around ten years—during which they scout promising startups, deploy capital, and eventually strive to cash out their investments.

Limited Partners vs. General Partners

General partners (GPs) run the day-to-day investment activities. Their job is to find, evaluate, and support startups. They also handle all legal, administrative, and reporting requirements. Limited partners (LPs) provide the funding but have little say over which startups are chosen. They are shielded from excessive risk and rely on GPs’ expertise to grow their investment. While the LPs effectively own most of the capital in the fund, the GPs make the decisions and receive a share of the profits, known as carried interest, if things go well.

Role of Venture Capitalists

When you hear “venture capitalist” (VC), it typically refers to the general partners or investment professionals within a venture fund. Their job extends well beyond writing checks. VCs continuously evaluate thousands of pitches, hunt for hidden gems, help startups shape strategy, join boards, and tap into their networks to help founders hire and grow. They stake their time and reputation on the startups they back and, ideally, ride along as those companies scale.

Now that you understand how venture funds are structured and who the main players are, let’s explore the different stages that startups pass through as they seek and secure venture funding.

Stages of Venture Capital Funding

Pre-Seed and Seed Rounds

The earliest funding moments feel experimental—a handful of people, a big idea, and empty pockets. In the pre-seed stage, founders often use personal savings or small checks from friends, family, or angel investors to sketch out a prototype and test their assumptions. Seed rounds come next: this is when the first institutional investors and seed funds arrive. Their checks aren’t massive, but they’re betting on potential. Most startups use this funding to build a functional product, assemble a small team, and gain early traction in the market.

Series A, B, C, and Beyond

Once there is evidence that customers want what a startup is offering, Series A rolls in. Here, funds are larger and expectations climb higher: clear user growth, early revenues, or measurable market fit. By Series B, the startup needs to prove it can scale—expanding to new markets, ramping up marketing, or even making key hires. Series C and later rounds are all about fueling rapid expansion and sometimes acquiring competitors or entering global markets. Each additional round is a bridge to bigger goals—and often, higher stakes.

What Each Stage Means for Founders

Each VC round isn’t just a bigger pile of cash—it’s a new chapter. Early rounds give founders more freedom to experiment but also come with more uncertainty. Later rounds deliver resources, talent, and industry connections, but also more oversight from investors and increased pressure to show results. The further along you go, the more transformative—and demanding—the relationship with your backers becomes.

Understanding these funding stages isn’t just helpful trivia; it’s how startups set the pace, scale at the right moment, and avoid getting stuck. Up next, we’ll pull back the curtain on how investors actually choose which startups to back—and what the process really looks like from inside the deal room.

The Venture Capital Investment Process

Sourcing Deals and What VCs Look For

Venture capitalists are always on the hunt for promising startups, but not every business idea catches their eye. Strong teams, scalable products, and a clear path to market are non-negotiable qualities. While some entrepreneurs approach VCs directly, many introductions happen through networks—trusted founders, industry connections, or other investors. Once a company lands on a VC’s radar, the focus turns to traction: early revenue, a passionate user base, or technology that stands out. VCs aren’t just betting on products; they’re investing in founders who spot opportunity, adapt quickly, and rally strong teams.

Due Diligence Explained

Getting a VC’s attention is just the first step. Due diligence is where the numbers—and stories—get scrutinized. Venture firms dig into financial statements, customer contracts, competitive positioning, legal matters, intellectual property, and even reference calls with customers or partners. This period is often a test of transparency and readiness; founders who can provide clear, organized information instantly build credibility. The due diligence process can range from a few weeks to several months depending on the complexity of the deal and the round size.

Term Sheets and Investment Terms

After a startup passes due diligence, the lead VC drafts a term sheet—a summary of the proposed investment’s structure. This isn’t just paperwork; it sets the rules for ownership, control, and upside. Key details include valuation, amount invested, board seats, liquidation preferences, and potential veto rights on major decisions. While the term sheet is usually non-binding, its terms guide final negotiations and legal agreements. Negotiating a fair term sheet requires both sides to balance ambition with protection—too many restrictions can stifle innovation, but too little oversight can spell trouble down the road.

Once these steps are complete and agreements are signed, a company officially joins the VC’s portfolio. But the journey doesn’t end there—what happens after the investment lands can be just as influential as the deal itself.

Life After Funding: What to Expect

What VCs Provide Beyond Capital

Once the check clears, your journey with investors shifts into a new gear. Venture capitalists don’t simply hand over cash and step out of sight—they often roll up their sleeves as partners and advisors. Many VC firms offer hands-on support, connecting founders with trusted recruiters, veteran operators, or potential customers. It’s not unusual for your lead investor to introduce you to a network of mentors, or even help you land your first major clients through their connections.

VCs can also offer guidance on thorny hiring decisions, pricing strategies, or product pivots. They’ve usually weathered plenty of startup storms, and the smartest founders learn to tap into that pattern recognition. But remember, this guidance is rarely unsolicited; founders who actively seek advice make the most of the relationship.

Board Seats and Expectations

With institutional funding comes more structure. Most venture rounds result in at least one VC joining your board of directors, giving investors a voice in your highest-stakes decisions. This added layer brings accountability—monthly or quarterly board meetings will become a fixture, where you’ll share metrics, milestones, and missteps.

Expect your board members to press for clarity on how you’re deploying capital and progressing toward growth targets. They won’t manage your company, but they will push you to think strategically, face tough realities, and sharpen your company’s story. Good board members challenge founders without wielding a heavy hand, striking a balance between support and scrutiny.

Adapting to this new dynamic takes time. But with the right partnership, you’ll find that post-funding life unlocks more than money—it can accelerate your growth and expand your vision. Next, let’s explore the possibilities and outcomes that this journey can lead to when your company is ready for the next big leap.

Thank you for reading EasyVC’s blog!

Are you looking for investors for your startup?

Try EasyVC for free and automate your investor outreach through portfolio founders!

Exiting Venture Investments

Acquisition, IPO, and Other Outcomes

Every venture investment has an endgame: a moment when investors seek to cash out. The most common exit is an acquisition, where a larger company buys the startup. Tech giants and established firms are always hunting for innovation, and acquiring startups lets them add fresh talent, products, and ideas to their portfolios. For founders and investors, an acquisition can mean a swift payday—although sometimes it is a strategic ‘acqui-hire’ offering mostly jobs for the team and a modest return for investors.

The most glamorous exit is an Initial Public Offering, or IPO. Here, the startup sells shares to the public for the first time, often unlocking outsize financial returns for early backers. However, going public is rare—IPOs come with intense scrutiny, regulation, and require the business to scale far beyond most startups’ reach. A third exit scenario is the so-called ‘secondary sale,’ where another private investor, such as a larger fund or late-stage investor, buys out earlier venture capitalists. Occasionally, companies fizzle out, and exits go sideways: assets might be sold off or written down, resulting in losses or minimal returns.

How Returns Are Generated

Venture capital funds are built on the promise of high-risk, high-reward dynamics. For most funds, a handful of investments deliver the lion’s share of returns. When a startup reaches a lucrative exit, the venture capitalists sell their shares—either to an acquirer, on the open market after an IPO, or to other private investors. The money flows back to the fund, which then distributes profits to the fund’s limited partners and to the venture capitalists themselves based on the fund’s economics.

These payouts are unpredictable and often take years to materialize. In fact, many startups will never reach a profitable exit, which is why VCs swing for the fences and aim to back startups with the potential for outsized outcomes. The hope is that one runaway success will make up for misses elsewhere in the portfolio.

Understanding how VCs get their money back sheds new light on the risks and dynamics founders face. Next, let’s look at what entrepreneurs should consider before shaking hands with investors, and how these exits can affect their own future in the company they’ve built.

Risks and Considerations for Founders

Loss of Control and Dilution

Accepting venture capital almost always means giving up a slice of your company’s ownership. With each new funding round, founders’ shares typically shrink. It’s not just a matter of smaller stock percentages—investors will likely want a seat at the table, from board votes to critical company decisions. Handing over equity and decision-making power can create tensions, especially if visions diverge down the road or tough calls need to be made.

Vesting, Preferences, and Founder Alignment

Venture deals are full of fine print: vesting schedules, liquidation preferences, special clauses designed to protect investors. These features can impact your own financial outcome, especially during an exit. For example, liquidation preferences may mean investors get their money back first, reducing what’s left for the founders. Vesting schedules can tie you in place longer than expected, shifting leverage if you consider moving on or if your relationship with investors becomes rocky.

It’s crucial for founders to read beyond valuation headlines and understand what each term means for their future—because what’s penciled in those agreements will have real consequences, both strategic and personal.

While these risks deserve serious thought, knowing what to expect after raising capital is equally important to make the most of your new partnership—prepare to navigate the day-to-day realities VC brings to your business.

Alternatives to Venture Capital

Bootstrapping and Revenue-Based Financing

Not every startup needs to chase outside investors. Many founders choose to bootstrap: that means using personal savings, reinvesting early profits, or relying on customer advances to fund growth. Bootstrapping can be tough, but it keeps you in control and helps you stay laser-focused on building something customers actually want.

If bootstrapping isn’t enough, revenue-based financing is another path. Here, lenders give you money now in exchange for a fixed percentage of your future revenue. Unlike VC deals, there’s no equity or board seats changing hands. Your repayments rise and fall based on how well your business is doing—so you avoid the pressure of fixed monthly repayments or the need to chase explosive growth.

Grants, Crowdfunding, and Other Options

Some startups fit the bill for government grants, particularly those in research-heavy or socially impactful spaces. Grants don’t ask for equity or repayment; the real challenge is navigating the applications and competition.

Crowdfunding brings your idea right to the public. On platforms like Kickstarter or Indiegogo, supporters pledge money in return for early access, products, or perks. If you have a passionate community or a standout product, this can help you launch while also building buzz and early customers.

Other founders turn to accelerators, pitch competitions, or even good old friends and family for startup fuel. No one path is right for every company—your choice comes down to your goals, industry, and appetite for control.

After exploring all these routes, it’s helpful to weigh the risks and trade-offs that come with different funding choices. Understanding what’s at stake can save headaches down the line as your business grows and evolves.