European Startup Founder: How I got Sequoia, Accel, a16z and top-tier funds to meet with me with no network

It’s not easy to have a strong network of investors. When you’re out in the market trying to get meetings with them, most of the common advice out there (LinkedIn, Substack, Medium, etc) is that you should “ask for warm intros from people of your network”. Which pretty much means going on LinkedIn and seeing if any of your connections is also connected with an investor you’re targeting.

But for me, as a founder, I always thought ‘‘Yeah…! Of course! I’m sure one of my former colleagues in banking/consultancy/university will have a lot of connections and, sure, will be a killer intro with Sequoia Capital…!’’

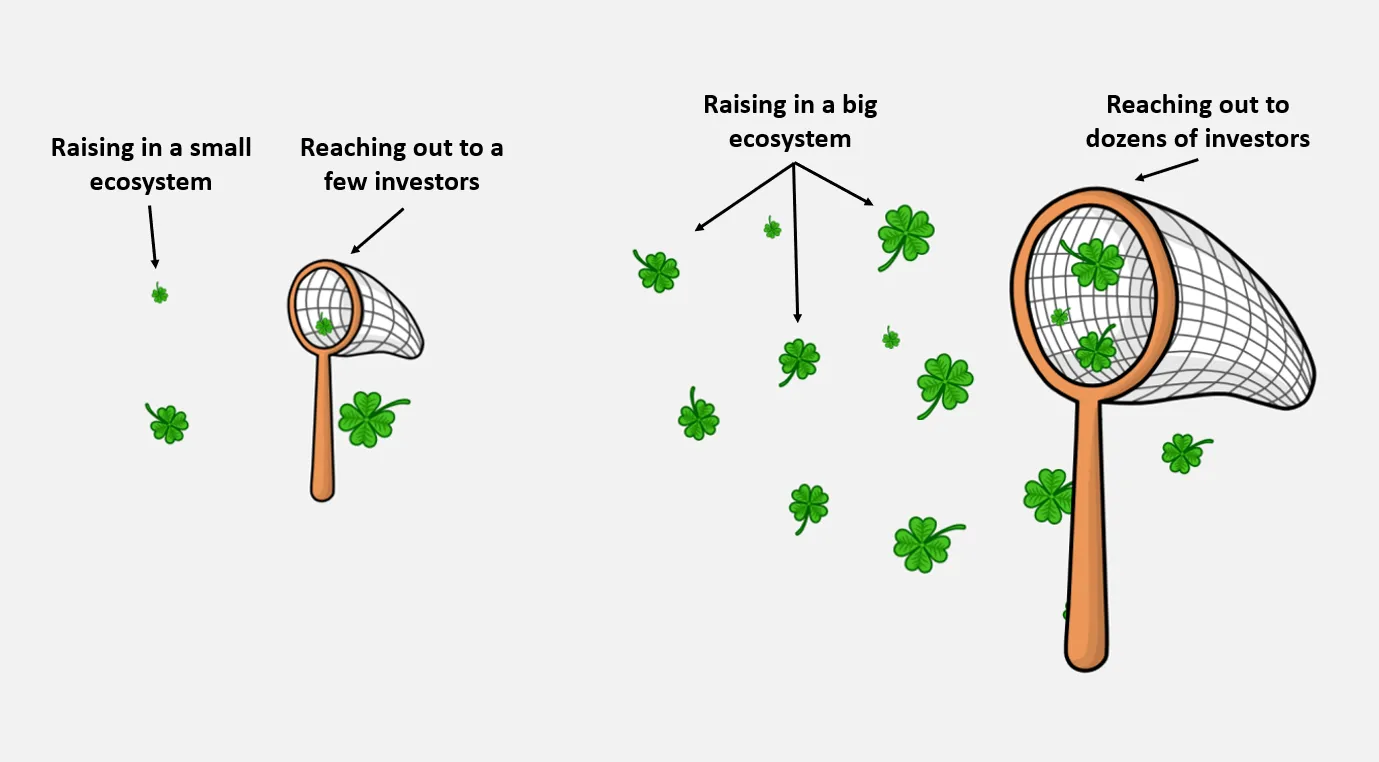

I think I don’t need to extend the joke further to get my point across. Founders with no network in the startup ecosystem can’t use that playbook. Even founders who have an existing network will find that network is always limited. In my last funding round, I already had 3 VCs in my cap table, and they had their respective network of investors with whom they shared boards, dealflow and connections.

But again, my VCs had a “limited” number of good intros they would make. Assuming that each can make 7 warm intros, that’s 3×7 intros = 21 intros. Great! Now I have 89 VCs left in my fundraising target list with whom I still don’t have a direct intro path.

As you can see, this playbook, which has been repeated over and over, is a nice-to-have strategy to save time and get very effective interactions with investors. However, if you really want to have real chances of raising capital, this is not going to be enough.

I think this advice was born in the capital of tech entrepreneurship, Silicon Valley, where I’ve spent a lot of time understanding the many dynamics that happen here. Being at Silicon Valley is a great strategy for any tech founder, it can be summarized to a place where the density of opportunities and surface area for random events propelling your business are the highest of the entire planet.

To give you some perspective, according to EasyVC’s database, there are more VCs in the San Francisco Bay Area than in the entire European Union.

But that’s the thing, that strategy works very well in Silicon Valley, since the density of people who might know investors is crazy. Therefore, if you have connections there, probably someone in your network would introduce you to someone, or someone that knows someone.

Unfortunately, for the 99% of the founders that don’t live the “fancy” startup life in San Francisco, that playbook is significantly less effective. So what do you do if you’re a US founder living far from major startup hubs, or a European founder living in a country with only 10 local VCs…?

You get the bigger butterfly net from above by forcing your network. And what’s the best network that you can have to make intros? Founders that raised capital from your target investors. More on this here and here:

The hard truth about this process is that, to be taken seriously and really grab investors’ attention, a warm intro is essential. As Marc Andreessen says in the video “The argument in favor of the warm intro is that it’s the first test of your ability to basically network your way to the investor”. If you think about it, if you can’t get an intro with a VC, how are you going to close massive deals, bring influencers onboard or present your solution at boards of public companies?

Now that the point is made, let’s take a look at the step-by-step process.

How to get warm intros with your target VCs

1. Go to the investor’s website and study their portfolio. Try to find companies in your space, research the LinkedIn profile of the founders, and reach out to 20 founders for each VC. Send a note to see if the founder would jump on a quick call so you can know about their personal experience with the VC.

Do you want access to the exact LinkedIn connection note I used with more than 900 founders to get warm intros? Just keep reading!

2. In our experience, 10 of them will answer, 2-3 will jump on a call with you and one of them will help you out making a warm intro. Here are some examples:

3. Here are some tips when talking to a founder of the VC’s portfolio:

- First, introduce yourself and talk about what you are building.

- Let the founder know that you have not had any previous interaction with the investor and that you’d like to know of their experience working with their investor.

- A few things you can ask the founder: if the investor helped them in the next round or not, how was their mentorship, and if they micromanaged or not, if they were quick in their due diligence process, if they are an overall good partner to have.

- Once you read the room and when you feel there’s chemistry with the founder, kindly ask for a warm introduction to their investor.

We have a long guide with the script I used during the call, a detailed explanation of the storytelling you should use for this, and the exact LinkedIn connection note I used with more than 900 founders to get warm intros. Access this resource here.

This is the strategy I used to speak with all top funds in Europe and the US I had on my target list.

You don’t need to spend thousands of dollars on flights to go to startup events worldwide to try to connect with investors. Just focus on LinkedIn and reach out to other founders.

Now it’s time for you to nail your funding round.