Data Rooms for Startups: How to Impress Investors and Protect Your Venture

Raising money for your startup is hard enough without worrying about what documents you need and how to share them. But the truth is, the difference between winning over investors and getting passed over often comes down to how well you prepare. According to a survey by DocSend, startups with well-organized data rooms are 35% more likely to successfully close a funding round compared to those without one. A good data room not only makes you look more professional—it helps investors trust you and protects your venture’s most valuable information.

In this guide, we’ll break down exactly what a startup data room is, when you need one, what to include (and what to skip), and the best ways to keep your documents safe and easy to access. Whether you’re gearing up for your first pitch or already fielding investor questions, having a data room can set you apart and keep your company’s secrets secure.

Understanding Data Rooms for Startups

Why Startups Need a Data Room

At their core, data rooms are secure digital spaces where startups organize and share the documents investors care about most—think cap tables, contracts, financials, and intellectual property details. For founders, a data room isn’t just about keeping things tidy; it’s your first real attempt at transparency during fundraising. By offering a single well-organized portal, you prove you’re serious, organized, and ready for due diligence, making it easy for investors to explore your business without endless email threads or messy folders.

Types: Virtual vs. Traditional Data Rooms

Long gone are the days of paper-filled conference rooms or password-protected USB drives. Modern startups rely on virtual data rooms: online platforms purpose-built for managing confidential files. These solutions automatically log activity, restrict downloads, and provide audit trails—crucial for tracking who saw what and when. Traditional physical data rooms, once used in high-stakes mergers, offer nostalgia and a paper trail, but little practicality for fast-moving startups spread across cities and time zones.

Who Should Have Access?

Not everyone needs a key to your data room. Access should be limited and thoughtful: co-founders, key advisors, and carefully-vetted investors who reach a certain stage of the fundraising conversation. Most startups use permission tiers, ensuring sensitive documents stay unavailable until trust is established. This protects your information, while also allowing you to monitor who’s engaging most—and where follow-up conversations should go deeper.

With the basics of data rooms in mind, it’s time to figure out the right moment to start building yours—before investor interest catches you off guard.

When to Build Your Data Room

Key Triggers for Creating a Data Room

There’s a sweet spot for constructing your data room: right before you start talking seriously with investors, but after you’ve gathered enough substance to show you mean business. If you wait until after a term sheet lands, you’re in panic mode. But if you assemble your data room too early—before you have customer traction or a clean set of financials—you’ll just end up updating files constantly and inviting unnecessary stress.

Consider building your data room when you’re ready to raise a pre-seed or seed round and you have investor meetings on your calendar. If you’re preparing for due diligence, or you’re getting requests for the same handful of documents (like your cap table or intellectual property filings), that’s your signal. Don’t wait until investors start asking for details—they’ll expect a near-instant response. A well-prepared data room says you’re not just winging it—you’re organized and transparent without oversharing.

Common Mistakes with Timing

It’s tempting to put off building a data room because fundraising feels far off. But scrambling at the last minute often means sharing half-baked files or, worse, possibly losing momentum with investors. Another mistake: creating a massive room filled with “just in case” documents months or even years before you really need it. That keeps your attention on busywork instead of growth, and it also increases the risk of outdated files getting in front of sharp-eyed investors.

Your best move? Start the skeleton early with basic folders, but only flesh it out as funding conversations get real. That way, you avoid a flurry of all-nighters or an accidental data dump that leaves investors hunting through clutter.

Once you’ve nailed the timing, what you include in your data room matters just as much. The next steps are all about making sure every document you provide builds trust and answers real investor questions—without opening yourself up to risk.

What to Include in a Startup Data Room

Company Overview & Pitch Deck

Kick things off with a concise overview of your company—no elevator pitches here, but a clear explanation of your mission, the problem you solve, and what makes your approach unique. Include your latest pitch deck, making sure it reflects your current vision, traction, and team strength.

Financials and Cap Table

Investors want to see the numbers. Add up-to-date financial statements: profit and loss, cash flow, and a balance sheet. For earlier-stage startups, include projections and clearly state your assumptions. Your cap table should be crystal clear, showing ownership breakdowns for founders, option holders, and existing investors.

Team Bios and Stakeholders

Introduce the team behind the curtain. Bios don’t need to be long—highlight relevant experience, critical hires, and advisers whose involvement moves the needle. If you have key partners or stakeholders, mention them and their role.

Market Research & Traction

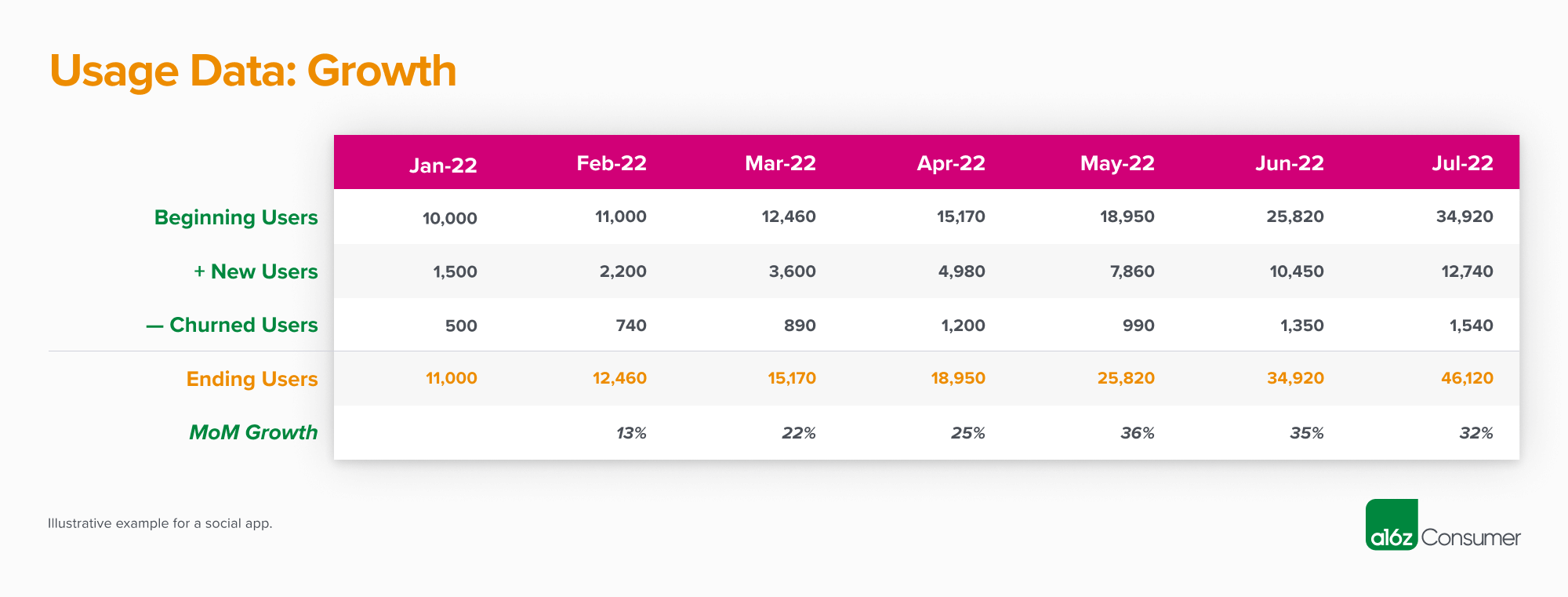

Show you’re not building in the dark. Share validated market research, customer discovery summaries, and snapshots of traction: growth metrics, key milestones, and notable wins. The best way to make your case is with clear data—whether that’s user growth, retention, or expanded pilots.

Legal, IP, and Incorporation Docs

Make it easy for investors to confirm you’re buttoned up legally. Upload your certificate of incorporation, bylaws, and founder agreements. If you own any intellectual property—like patents or trademarks—include the docs or filings.

Customer Contracts & References

Proof customers actually pay for your product—or are about to—matters more than a handful of testimonials. Add current contracts (redacted if needed) and reference contacts willing to vouch for your team.

Product Details & Roadmap

Give a peek under the hood. Share product screenshots, technical architecture docs (if relevant), and your current roadmap. Highlight what’s shipped, what’s next, and any critical dependencies or risks you’re managing.

With your data room contents dialed in, you’re one step closer to building investor trust. Now, let’s look at common missteps and how to avoid opening unexpected vulnerabilities while setting up your data room.

What to Avoid in Your Startup Data Room

Sensitive Data That Puts You at Risk

Not everything belongs in your data room. Including unredacted customer lists, personal employee data, or proprietary tech details can open the door to leaks or potential legal problems. Investors want reassurance that you understand the boundaries of confidentiality—leave out anything that could compromise your employees’ privacy, customer trust, or your competitive edge. If you must share sensitive information, anonymize names or numbers and watermark documents to prevent unauthorized distribution.

Unnecessary or Outdated Documents

A bloated data room distracts and frustrates investors. Purge anything no longer relevant—old funding proposals, expired contracts, or dusty business plans. Always replace outdated pitch decks or press coverage with only the most current, accurate versions. Think of your data room like a display window; only showcase what stands up to scrutiny today. Irrelevant files slow down decision-making and make you appear disorganized or careless about details.

Red Flags That Deter Investors

Avoid documents that raise more questions than they answer. Missing founder vesting schedules, unclear IP ownership, inconsistent financials, or sketchy contracts signal disorganization or deeper issues. Don’t gloss over lawsuits, regulatory pressures, or missing signatures in key agreements—investors usually find them anyway. Instead, address gaps transparently with brief explanations or corrective actions attached. Leaving these pitfalls for a sharp-eyed investor to discover on their own erodes the trust you are striving to build.

By steering clear of clutter, exposure, and avoidable slip-ups, you make it easier for investors to focus on what really matters about your business. Now that you know what to keep out, let’s shift to the question of which platform and features can keep your hard work—and your reputation—safe.

Choosing the Right Data Room Solution

Key Features to Look For

Every minute investors spend frustrated by a confusing interface is a minute they’re not learning about your business. Prioritize data rooms with simple navigation, bulletproof search, and fast document preview—because no one wants to download a dozen files just to find the term sheet. Granular permission controls are a must: you want to share precisely what’s needed, and not a byte more. Look for features like watermarking, activity tracking, and custom access expiry. These protect sensitive material while impressing investors with your professionalism.

Popular Platforms Compared

Not all platforms are created equal. Some, like DocSend and Dropbox DocSend, have nailed the startup experience: streamlined design, investor-friendly analytics, and straightforward pricing. Others, such as FirmRoom or iDeals, offer advanced security but may require more setup time or come wrapped in enterprise baggage that isn’t ideal at seed stage. If you’re managing a simple raise, something lightweight wins. For complex fundraises or cross-border deals, consider platforms vetted by major VCs for their compliance and support.

Budget Considerations for Early-Stage Startups

Founders don’t want another monthly drain. Luckily, many top providers offer startup programs or free trials—always ask for access. Some even let you operate for free up to a certain document or user threshold. Steer clear of annual contracts and fine print that locks you in. Instead, evaluate value per feature: do you need advanced reporting, or will essentials suffice? Save your budget for growth, not just storage.

Once your data room solution is in place, organizing and maintaining its contents sets the tone for every investor interaction. The way you structure and update information can turn due diligence from a headache into an asset—let’s look at strategies that keep your data room ready at every stage of your fundraising journey.

Best Practices for Managing Your Data Room

Structuring and Organizing Documents

Think of your data room as a map for investors—a clean folder structure speeds up their journey to your startup’s truth. Group files by theme: finance, product, legal, team. Avoid burying documents five folders deep; two levels of nesting is enough. Use clear, date-stamped filenames like 2024Q1_Financials.pdf so nobody opens the wrong version. Consider a “Read Me First” file at the top to set the stage for new visitors.

Updating and Maintaining Your Data Room

Investor diligence isn’t a one-time event. Schedule regular reviews: prune obsolete drafts, replace out-of-date metrics, and archive anything irrelevant. This not only keeps you ready for the next investor conversation, but it signals to existing viewers that your company runs a tight ship. Use tools that track version history, so you can always roll back if you remove something crucial.

Granting, Tracking, and Revoking Access

Be surgical with permissions; every click inside the room leaves an audit trail. Use view-only settings for most visitors, enabling downloads only when absolutely necessary. Limit each investor’s access to what’s actually relevant for their stage of interest—don’t reveal everything at once. Set calendar reminders to periodically review who has access, especially after a fundraise or a team change: revoke credentials that are no longer needed, and flag unexpected logins.

Mastering these management habits doesn’t just keep your secrets safe—it impresses investors by demonstrating operational discipline. Now, let’s explore some of the most common questions entrepreneurs face on this journey, and how to handle them with confidence.

FAQ: Startup Data Rooms

When do investors expect to see a data room?

Investors typically want access to a data room once a startup reaches serious funding talks—usually during a late-stage seed round or before a Series A. At this point, they expect organized documents that back up every claim in your pitch, including team credentials, cap tables, user traction, and contracts. Even if not specifically requested in early meetings, having a data room ready signals you’re prepared and diligent.

How secure are modern data rooms?

Contemporary virtual data room services use bank-grade encryption, two-factor authentication, and detailed user permissions. Audit logs track every file view or download. While no system is immune to risk, best-in-class data rooms make it extremely difficult for unauthorized parties to snoop or copy documents.

What if confidential info is leaked?

A genuine leak is rare in reputable data rooms, but if it happens, most platforms give you a digital trail—pinpointing who accessed what and when. You can instantly revoke user access and change passwords. To lower the risk further, avoid storing ultra-sensitive information (such as unreleased patents or passwords) in the data room. If legal action is necessary, those audit logs offer critical evidence.

Grasping these common questions will help you navigate your options and set investor expectations from the start. With the basics covered, it’s time to get a handle on the tools and criteria that’ll shape your choice of data room platform.