Currency Conversion Consolidation Guide

If you’ve ever tried to bring together financial results from businesses operating in different countries, you know how quickly things can get complicated. The simple act of converting currencies can have a big impact on how accurate and useful your consolidated financial statements end up being. In fact, according to a Deloitte survey, nearly 60% of multinational organizations see currency translation as one of their top consolidation challenges.

This guide is here to help you cut through the confusion. We’ll look at why currency conversion matters so much during consolidation, what the most important terms and rates mean, and how you can avoid costly errors. Whether you’re consolidating financials in a small team or at a growing global business, understanding these steps will make your process smoother and your results more reliable.

Why Currency Conversion Matters in Consolidation

Challenges with Multiple Currencies

When a company spans continents, its subsidiaries often report revenues, costs, and assets in local currencies. Bringing these financial results together means tackling more than just language barriers—the numbers themselves need translating. Without accurate conversion, the consolidated statements become a jumble of apples and oranges, making true performance invisible.

Risks of Incorrect Conversion

Missteps in currency conversion can snowball through consolidated financials. A simple oversight—like using out-of-date exchange rates—can introduce distortions that ripple across profit figures, asset valuations, and shareholder equity. Even small discrepancies threaten credibility, disrupt ratios, and could trigger audit red flags.

Understanding the importance of precise currency conversion sets the stage for navigating core concepts and tools essential for smooth, transparent consolidation across every border.

Essential Currency Conversion Concepts

Spot, Average, and Closing Rates Explained

When translating foreign financial statements for consolidation, not all exchange rates serve the same purpose. The spot rate captures the current market rate at a specific date—think of it like taking a live financial snapshot. The average rate smooths out fluctuations by averaging rates over a period, offering a balanced view for recurring revenues or expenses. The closing rate is the rate at the exact point when the reporting period ends, used mainly for assets and liabilities that are revalued at the end of each period.

Choosing the right rate means more than just accuracy: it impacts everything from reported profits to compliance with accounting rules.

Accounting Standards for Currency Translation

Rules for currency translation vary by accounting standard but the basics remain similar across frameworks. IFRS, for example, uses IAS 21, which distinguishes between monetary and non-monetary items, dictating when to use spot, average, or historical rates. US GAAP follows ASC 830, which addresses functional currency determination and how translation adjustments hit other comprehensive income instead of net income. Knowing which rulebook applies ensures you maintain consistency and avoid misstatements in consolidated results.

Now that the key concepts are in place, it’s time to roll up our sleeves and see how these principles work in practice as you prepare your own consolidated financial statements.

Step-by-Step Currency Conversion in Consolidated Financials

Gathering Exchange Rate Data

Begin by collecting reliable exchange rate data for all currencies involved. Use official sources—such as central banks or trusted financial data providers—to fetch spot, average, and closing rates for the relevant periods. Document rate sources carefully, as inconsistencies can lead to reporting errors or compliance issues.

Applying Rates to Financial Statements

Once you have the necessary exchange rates, apply them to each line item in the subsidiaries’ financial statements according to its type and the reporting standard in use. For example, assets and liabilities on the balance sheet typically use the closing rate, while income and expense items on the income statement often rely on the average rate for the period.

A spreadsheet setup helps visualize which items require which rates, reducing the chance of overlooked details or misapplication.

Eliminating Intercompany Balances

Next, eliminate balances and transactions between consolidated entities. Convert these amounts into the group’s reporting currency before eliminating them, ensuring you use consistent rates across matched transactions. This process prevents income or expenses from being counted twice and corrects any exchange difference arising between subsidiaries.

With the individual and intercompany figures properly translated and reconciled, it’s time to review the resulting consolidated statements for accuracy and completeness—a step covered in the following section.

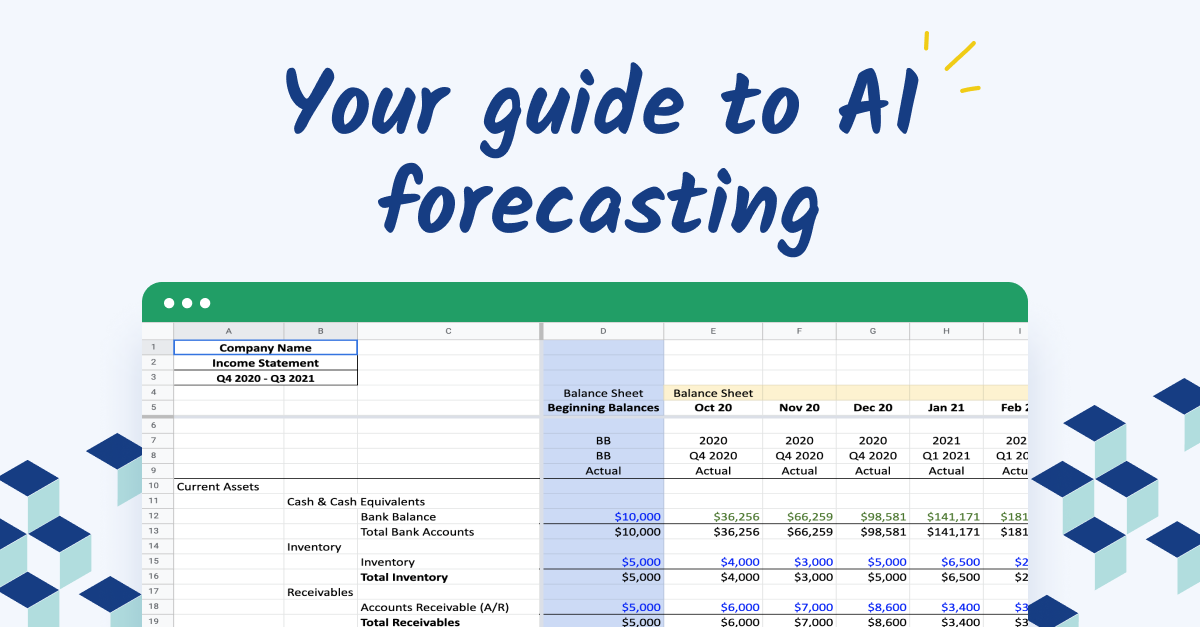

Practical Tools and Software for Multi-Currency Consolidation

Popular Platforms and Spreadsheet Solutions

Managing consolidation across currencies starts with the tools you choose. Cloud-based platforms such as Cube, NetSuite, and FloQast integrate exchange rates, automate conversions, and centralize your financial data. For those still using Excel, add-ins like Power Query can pull in up-to-date rates and handle currency mapping with formulas. Google Sheets offers similar connectivity using built-in functions and add-ons, though it may require manual oversight for complex company structures.

Automating Exchange Rate Updates

Manual entry of forex rates leads to mistakes and wasted hours. Instead, look for systems that fetch daily spot, average, or custom rates directly from data providers (like Xignite, OANDA, or your ERP’s feeds). Most modern consolidation tools let you schedule these updates, assign them to specific subsidiaries, and lock historical rates for audit reliability. Automation ensures all entities use consistent, timely rates, eliminating reconciliation headaches later.

Reporting and Audit Trails

Transparent reporting protects you during audits and simplifies reviews. Platforms with built-in audit trails log every rate change, approval workflow, and formula adjustment. Look for customizable reports that show converted values, source rates, translation differences, and entity-by-entity breakdowns. You’ll also want the power to drill down—from group summaries to original transactions—for full traceability.

Equipped with the right digital toolkit, you can turn a tangled web of international accounts into a streamlined, unified view. Up next, we’ll unravel techniques for handling the bumps in the road—like variable rates and partial ownership—that tend to trip up even seasoned consolidation pros.

Common Issues and How to Resolve Them

Dealing with Fluctuating Exchange Rates

Exchange rates don’t sit still. They shift—sometimes subtly, sometimes dramatically—between the moment a transaction happens and when you consolidate reports. Using mismatched rates can mean overstated profits or understated losses. For monetary items, always look up the closing rate on the balance sheet date; for revenue and expenses, use the average rate for the period unless accounting rules say otherwise.

If your consolidation runs over several months, set a routine to update exchange rates each reporting period. Automate rate pulls when possible, either by linking your spreadsheet to reputable financial data feeds or activating built-in features in consolidation software. This helps you avoid grubby manual errors and reduces surprises from wild currency swings.

Addressing Partial Ownership and Exclusions

Things get trickier when your group structure includes joint ventures or partially owned entities. Not every subsidiary’s financials are rolled in the same way. For these cases, pay attention to proportionate consolidation or equity method adjustments. Always double-check local rules—sometimes specific assets or liabilities are left out or only a segment of earnings is included.

To avoid over- or under-inclusion, keep a clear map of group ownership and ensure your consolidation process follows the right path for each entity. Tag and flag what’s excluded and why, so your consolidated numbers make sense to auditors and stakeholders alike.

Once you sidestep these common pitfalls, making sense of multi-currency consolidated figures becomes much more reliable. Next, let’s see how all of these techniques come together through a practical, real-world scenario.

Real-World Example: End-to-End Currency Conversion Consolidation

Imagine Global Techover Ltd., a US-based parent company with subsidiaries in Canada, the United Kingdom, and Japan. Each subsidiary prepares financial statements in their local currencies: Canadian dollars (CAD), British pounds (GBP), and Japanese yen (JPY), respectively. Each year, the parent needs a consolidated view in US dollars (USD).

The process kicks off with each subsidiary sending over their finalized trial balances. For this illustration, suppose the Canadian division reports $2M CAD in revenue, the UK arm has £1.2M GBP, and the Japanese entity posts ¥200M JPY.

The treasury team collects the required exchange rates—average rates for income statement items and closing rates for balance sheet items. For example, they use an average annual rate like 1 CAD = 0.75 USD, 1 GBP = 1.30 USD, and 100 JPY = 0.93 USD for revenues.

Once rates are in hand, the actual conversion happens. The Canadian subsidiary’s revenue translates as $2M CAD × 0.75 = $1.5M USD. UK revenue becomes £1.2M × 1.30 = $1.56M USD. Japan’s ¥200M × 0.0093 = $1.86M USD. The parent company now totals $4.92M USD in consolidated revenue, as if all sales happened in one currency.

Balance sheet items like cash, receivables, and liabilities are converted using the closing rate on the reporting date. Any differences arising from fluctuating rates are recognized in a separate equity line called the cumulative translation adjustment.

Intercompany transactions and balances—such as loans between UK and Japanese subsidiaries—are eliminated in consolidation, using consistent translated values. This avoids double-counting and ensures the final US dollar figures present one unified financial position.

The result: Global Techover’s financial team can analyze performance across all regions, compare profits, and make data-driven decisions based on a single, coherent USD-based report. This clarity is possible only through careful conversion of every line item and thorough elimination of duplications.

Now that we’ve walked through a complete example, let’s examine some of the most common technical issues that arise when converting currencies across global operations—and explore proven ways to tackle them effectively.

FAQ: Currency Conversion in Consolidated Reporting

Q: Do all subsidiaries need to use the same currency as the parent company in consolidated reporting?

No. Each subsidiary can operate in its own functional currency. During consolidation, their financials are translated into the group’s reporting currency using prescribed exchange rates.

Q: How do I choose the correct exchange rate for different accounts?

Assets and liabilities are typically translated at the closing rate (rate on the balance sheet date). Revenue and expense items usually use the average rate for the reporting period. Some special items may require the historical rate from transaction dates.

Q: What happens if exchange rates fluctuate dramatically during the reporting period?

Large fluctuations can introduce significant translation differences, usually recognized in other comprehensive income or equity. Closely monitoring rates and documenting methodologies helps explain and justify conversion outcomes.

Q: How should intercompany transactions be handled across currencies?

Intercompany balances and transactions must be eliminated during consolidation. They’re translated into the reporting currency using consistent rates for the related group companies, ensuring that no artificial gains or losses are reported.

Q: Can automated software fully handle currency conversion for consolidation?

Many tools automate rate application and adjustments, but periodic checks and manual reviews are still needed for exceptions, rate updates, or nonstandard scenarios.

Q: Where do gains or losses from currency translation get reported?

Translation differences are generally recorded in other comprehensive income, not in the profit or loss statement, unless specified by accounting policy (such as when disposing of a foreign operation).

Having a solid grasp of these essentials makes it easier to spot and avoid the most frequent pitfalls in currency conversion. Up next, let’s address what to do when things don’t go as planned, and how to fix the common issues that crop up during consolidation.