{archive_title}

Category: Uncategorized

-

Understanding Sweat Equity: Meaning, Applications, and Benefits

In the world of finance and entrepreneurship, the concept of sweat equity holds a special place, transforming mere effort and dedication into tangible value. Sweat equity isn’t just a buzzword; it’s a fundamental principle that underscores the power of personal investment in ventures big and small. But what does sweat equity truly entail, and how…

-

Innovative Examples of Product-Led Growth Strategies

In today’s highly competitive business landscape, companies are continually seeking innovative strategies to foster growth and gain an edge over the competition. Product-led growth (PLG) has emerged as a transformative approach, allowing organizations to achieve sustainable expansion by leveraging their product as the primary driver of acquisition, retention, and expansion. This strategy shifts the focus…

-

Understanding Churn Rate: Meaning, Calculation, and Strategies

In today’s competitive business landscape, understanding and managing churn rate is more critical than ever. Whether you’re a startup aiming for sustainable growth or an established enterprise seeking to retain your customer base, knowing how to keep churn in check can be the difference between success and stagnation. The churn rate not only reflects the…

-

The Ultimate Guide to Startup Incubators: How They Can Propel Your Business Forward

In the dynamic landscape of entrepreneurship, where ideas can become industry-shaping powerhouses, startup incubators play a crucial role. These programs offer the support, resources, and guidance necessary for fledgling companies to thrive. Whether you are a new entrepreneur with a groundbreaking idea or a small business looking to scale up, incubators can be the launchpad…

-

Unlocking Investor Connections for Your Startup: How EasyVC Can Transform Your Fundraising Journey

When you’re a startup founder, finding the right investors can feel like searching for a needle in a haystack. But what if there was a way to make this process faster and more efficient? Enter EasyVC, your AI-powered partner in discovering investors for your startup business. In this blog post, we’ll explore how EasyVC can…

-

Mastering Your Round of Funding with EasyVC: Fast-Track Your Startup’s Success

Discover how EasyVC transforms the fundraising journey for startup founders by providing AI-driven insights and warm introductions to investors. With over 50,000 venture capital and business angel contacts, EasyVC streamlines your round of funding, offering tools, guides, and invaluable connections. Learn how to optimize your capital-raising efforts with EasyVC today. When it comes to raising…

-

Startup Exit Strategy, Why Investors Are Asking Me This?

As a startup founder, planning your exit strategy may not be at the forefront of your mind. However, proactively devising a well-thought-out exit strategy can significantly impact your startup’s future growth and success. Neglecting this crucial aspect could restrict your business’s potential and leave you scrambling when major changes arise. This guide will walk you…

-

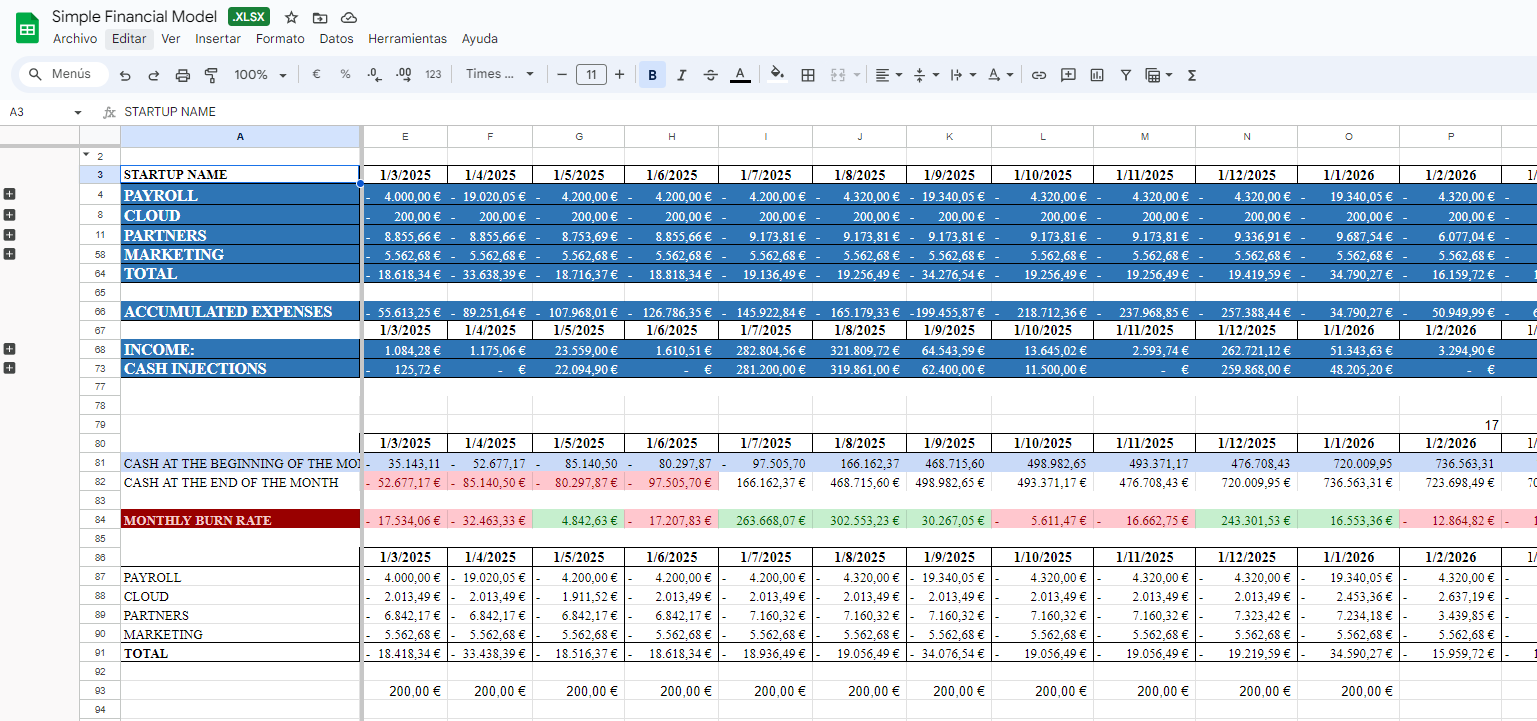

Startup Financial Forecast Template for Your Fundraising Journey

A great startup financial forecast template can transform your decision making and your fundraising efforts. Learn about key components, customization, and access a free template to streamline your financial planning. Why Financial Forecasts Matter for Startups As entrepreneurs, we need financial forecasts that are easy to understand, even for founders without a financial background. Clear…

-

How to Find Investors for Startups: Simplifying Your Funding Journey with EasyVC

Discover how to find investors for startups effortlessly with EasyVC. Skip the research, and fast-track your funding with our AI-powered chatbot that connects you to over 38,000 active investors. Sign up now! How to Find Investors for Startups: Simplifying Your Funding Journey with EasyVC Starting a new venture is an exhilarating journey, but finding the…

-

Understanding 409a Valuation for Your Startup

In the world of finance and business, understanding the nuances of company valuations is crucial, especially when it comes to handling employee compensation through stock options. One term that consistently crops up in this arena is the “409A Valuation.” While it might sound like just another financial acronym, a 409A valuation plays a pivotal role…