{archive_title}

Category: Uncategorized

-

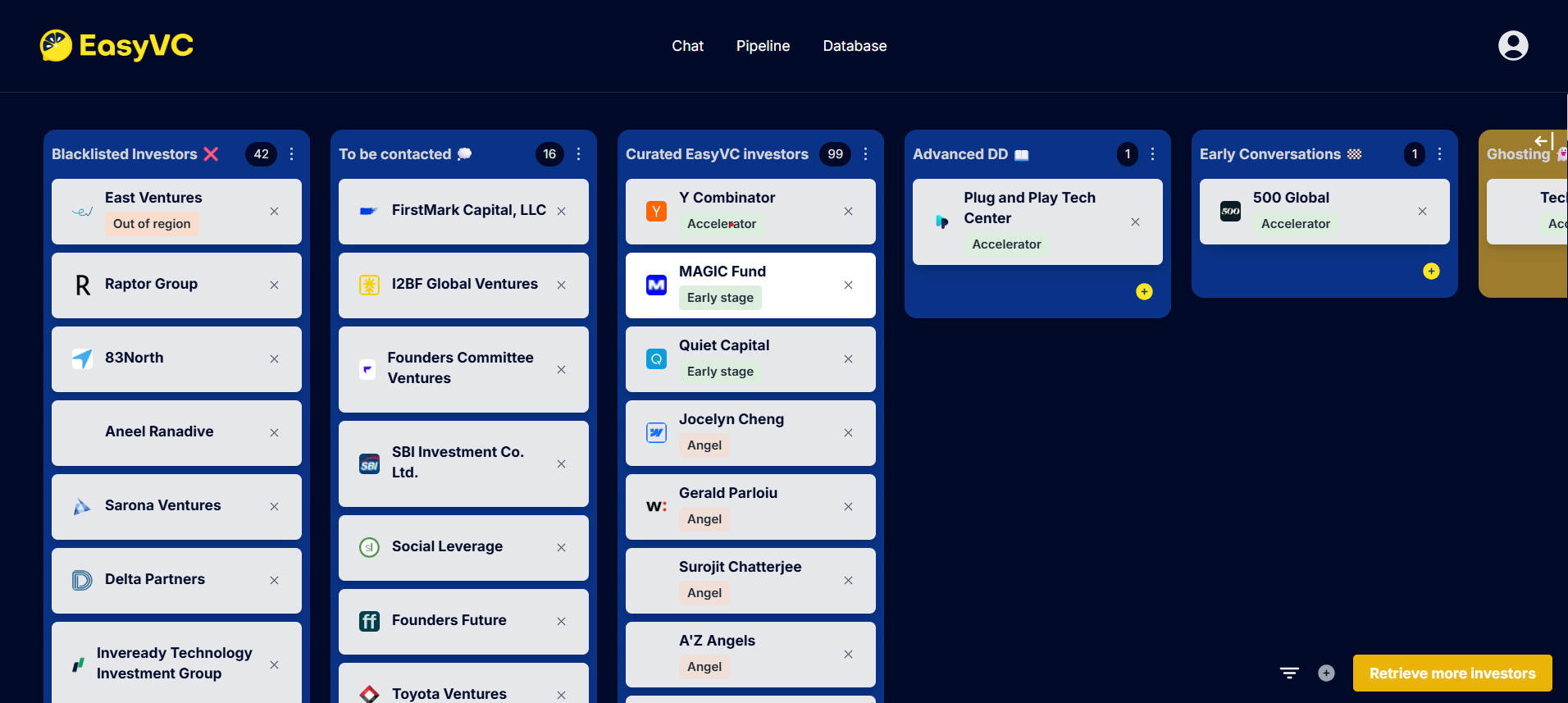

Best Fundraising CRM platforms with AI Features

Comparison Table Feature EasyVC AngelList Tracxn Visible VC PitchBook OpenVC Foundersuite Kaspr CB Insights Crunchbase Dealroom AI‑based investor matches Yes No No No No Yes No No No No No LinkedIn outreach automation(Chrome extension) Yes No No No No No No Yes No No No 1‑on‑1 coaching sessions Yes No No No No No No No No No…

-

Effective Investor Update Engagement Tips

In today’s fast-paced financial world, maintaining a robust relationship with investors is crucial for any organization’s success. Investor updates play a pivotal role in nurturing these relationships, serving as a bridge between a company’s strategies and its stakeholders’ interests. These communications provide transparency, foster trust, and ensure that investors are abreast of the latest developments,…

-

Strategies to Improve Diversity at Your VC Fund

In recent years, the conversation around diversity and inclusion has taken center stage in many industries, and the venture capital (VC) sector is no exception. As risk-takers and pioneers in funding innovation, VC funds have a significant opportunity—and responsibility—to lead by example when it comes to embracing diversity. However, achieving meaningful diversity requires more than…

-

Effective Strategies to Simplify Your Fundraising Funnel

In today’s competitive nonprofit landscape, crafting a seamless and efficient fundraising funnel is more crucial than ever. With countless organizations vying for donors’ attention, simplifying your fundraising funnel can significantly enhance donor engagement, streamline your processes, and ultimately drive more successful campaigns. This blog post will explore practical strategies and best practices to optimize your…

-

Essential Metrics to Track Sales Enablement Success

The landscape of sales is continuously evolving, and at its core, sales enablement plays a pivotal role in driving success. Organizations across various industries are capitalizing on sales enablement strategies to boost sales performance, improve productivity, and align marketing efforts. However, the key to unlocking the full potential of these strategies lies in tracking the…

-

Weekly recap in VC April 21st

As we head deeper into 2025, the venture capital landscape is shifting fast — and so are the strategies founders need to stay ahead. This week’s standout reads span everything from the power of thoughtful communication with investors to hard-hitting questions you should ask before signing a term sheet. We’re seeing bootstrapped solo founders gain…

-

Mastering the VC Investment Memo: Insights and Best Practices

In the world of venture capital, the investment memo represents a crucial artifact that captures the essence of potential deals and guides decision-making processes. Going beyond the glossy visuals and concise slides of a pitch deck, an investment memo provides a comprehensive analysis of a company’s fundamentals, offering insights into its potential to disrupt markets…

-

Understanding Healthcare Venture Capital Trends

The landscape of healthcare venture capital has evolved significantly over the years, driven by a rapid escalation in technological advancements and a growing demand for innovative healthcare solutions. As venture capitalists strategically position themselves to capitalize on these shifts, understanding the nuances of this dynamic field becomes more critical than ever. This comprehensive exploration delves…

-

Exploring Venture Capital in Vietnam

In recent years, Vietnam has emerged as a vibrant hub for venture capital, attracting investors from around the globe. This Southeast Asian nation is now recognized not only for its rich cultural heritage and dynamic economy, but also for its burgeoning start-up ecosystem that presents vast growth opportunities. The rapidly evolving Vietnamese venture capital landscape…

-

Understanding Venture Capital Interval Funds

In the world of finance, understanding the diverse array of investment opportunities is crucial for making informed decisions. Among these, venture capital interval funds have emerged as a significant yet nuanced option for investors looking to diversify their portfolios. These funds combine the dynamism of venture capital with the structured investment approach of interval funds,…