Cash Flow Projections: How to Forecast and Manage Business Cash

Managing a business means keeping an eye on the money coming in and going out—but it’s not always as simple as checking your bank balance. Even profitable businesses can run into trouble if they don’t have enough cash on hand at the right moment. In fact, 29% of small businesses fail because they run out of cash, according to a report by CB Insights. That’s why learning how to project your cash flow isn’t just useful—it’s essential.

Cash flow projections help you look ahead and spot potential shortfalls or opportunities before they happen. Whether you’re planning for growth, preparing for uncertainty, or just trying to make payroll on time, understanding how to forecast and manage your business cash can be the difference between thriving and struggling. Let’s break down what cash flow projections are and how you can use them to make more confident business decisions.

What Is a Cash Flow Projection?

A cash flow projection is a forward-looking estimate of how much money will move into and out of your business over a certain period. It pinpoints when cash is expected to arrive from sales, loans, or other sources, and when payments—like bills, payroll, or rent—will go out. Unlike a profit and loss statement, which focuses on accounting earnings, a cash flow projection is all about actual cash: what’s in your bank account and what you expect to have soon.

Building a projection lays out the timing and amount of cash you’ll need to cover everyday expenses. It helps you avoid tight spots where you might struggle to pay suppliers or staff, and spots surplus cash that could be invested or saved.

How Cash Flow Projections Work in Practice

Imagine laying out a calendar for the next six or twelve months. For each month, you estimate how much money will come in—say, from customer payments—and what’s due to go out, such as rent or supplier invoices. By recording this, you see at a glance whether your bank balance is likely to dip below zero or if you’ll have cash on hand to seize new opportunities.

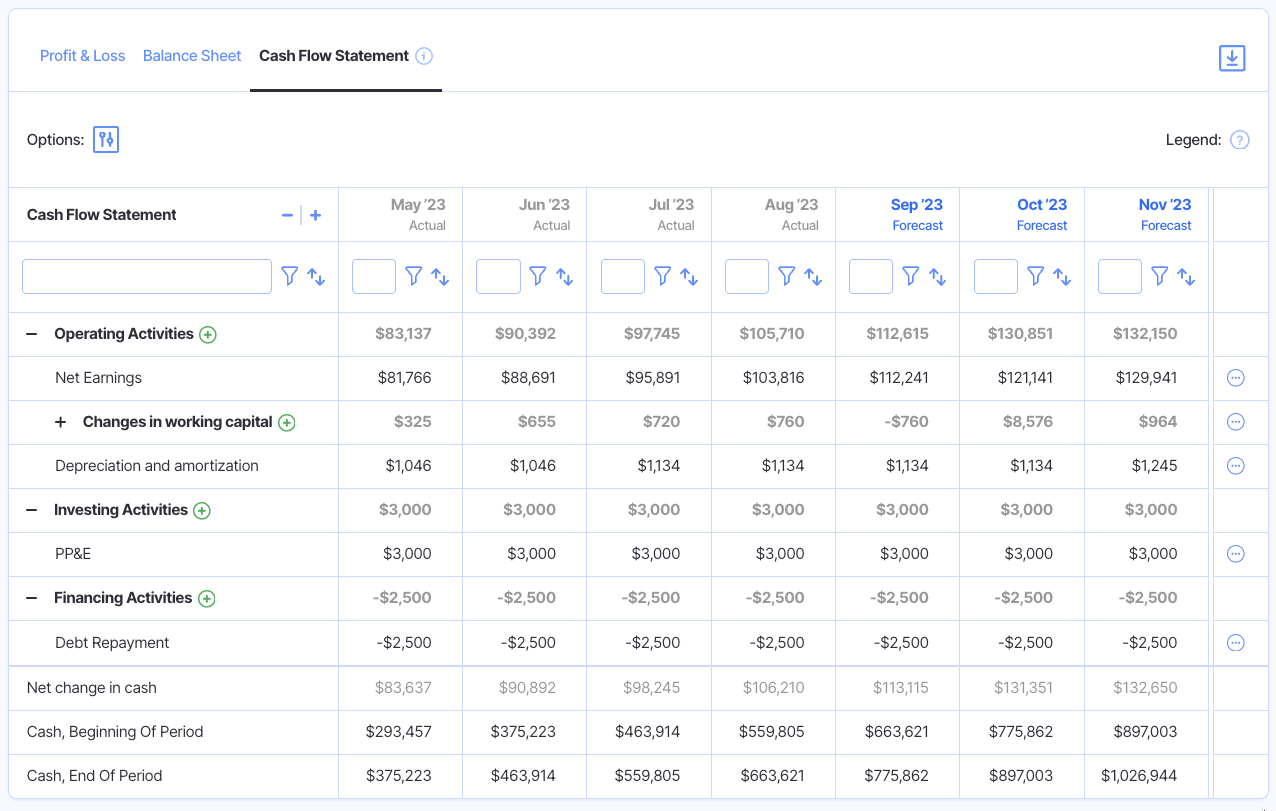

The image above demonstrates a typical cash flow projection. Notice how it lists actual and expected cash moving in and out, not just projected profits.

Cash Flow Projection vs. Cash Flow Forecast: The Difference

The terms “cash flow projection” and “cash flow forecast” often get mixed up, but there’s a subtle distinction. A cash flow projection typically refers to a planned estimate made for budgeting or strategic planning. A forecast, on the other hand, involves updating those estimates as you compare them with what’s really happening, making adjustments as new data rolls in. Both tools aim to keep you aware of your financial position—projections set expectations, and forecasts track your progress against them.

Now that you know what a cash flow projection is and how it works, it’s worth exploring why this tool can make or break your business’s financial health.

Why Cash Flow Projections Matter for Businesses

Imagine steering a ship without knowing how much fuel you have left. That’s what running a business without cash flow projections is like. These forecasts offer more than just a peek at your financial health—they help you steer clear of storms and spot new opportunities.

Planning for Growth and Uncertainty

Business journeys rarely follow a straight road. Cash flow projections reveal whether you’ll have enough on hand to launch a new product, expand into a different market, or simply keep pace when the unexpected pops up. By testing out what-ifs—like a big order or a sudden dip in sales—you get early warnings about tight spots or a heads-up when you can invest. This clarity lets you adjust plans rather than scramble at the last minute.

Securing Loans or Investment

Banks and investors don’t back hunches. They look for evidence you can manage cash wisely. A clear cash flow projection makes your business plan real—showing when you’ll need support, how you’ll repay, and where growth becomes sustainable. It shows you’ve done your homework, making you a more credible bet for financing.

Preventing Cash Shortfalls

Profit doesn’t always mean cash on hand. Seasonal dips, delayed invoices, or sudden bills can sneak up quickly. Cash flow projections help you predict these gaps before they become emergencies. Instead of reacting to an empty bank account, you get time to cut costs, chase payments, or negotiate with suppliers. This breathing room can make all the difference for your team and your reputation.

Understanding why these forecasts matter sets the stage for building your own. Next, you’ll see how to break down every moving part of a solid cash flow projection—turning unpredictability into a manageable process.

Key Components of a Cash Flow Projection

Cash Inflows: Sales and Other Income

Think of cash inflows as every dollar that comes into your business. The main source is typically sales—money paid by customers for products or services. But inflows can also include loan proceeds, tax refunds, grants, and interest earned. If you offer credit to customers, remember that the timing of when cash actually lands in your account matters more than when you send an invoice. A detailed cash inflow forecast lets you pinpoint when to expect real cash, not just promised revenue.

Cash Outflows: Fixed and Variable Expenses

Every business has to spend money to keep the doors open. Cash outflows capture every payment you make—monthly rent, inventory, wages, utilities, loan repayments, and taxes. Some expenses stay steady (like rent), while others fluctuate with activity (like supplies or commissions). The trick is anticipating both the regular bills and the sneakier, less frequent ones, such as annual subscriptions or unexpected repairs. Accurate outflow tracking helps avoid cash surprises.

Understanding Opening and Closing Balances

A clear cash flow projection always shows your starting cash (opening balance) and where you’ll stand after all inflows and outflows (closing balance) for each period. Your opening balance is simply the amount of cash you have at the start of the month (or week or quarter, depending on your timeline). After you factor in all money moving in and out, your closing balance reveals whether you’ll finish the period safely in the black—or risk dipping into the red. Monitoring these balances period by period helps you spot cash gaps before they become crises.

With the essential building blocks of cash flow projection in place, the next step is to assemble these components into a practical forecast—so you can see your business’s cash position before it happens.

Step-by-Step: How to Create a Cash Flow Projection

1. Set Your Projection Period

Choose how far into the future you want to look—usually weekly, monthly, or quarterly. Short-term periods (like 12 weeks) are practical for tight cash cycles, while longer periods help manage big-picture planning.

2. List and Estimate Cash Inflows

Identify every source of money you expect, starting with sales. Don’t forget things that aren’t regular, like tax refunds, grants, or one-off invoices. Review your bank records and customer contracts to make reasonable estimates by period.

3. List and Estimate Outflows

Write down all payments you expect to make: rent, payroll, supplier invoices, loan repayments, subscriptions, taxes—even small expenses like office supplies. Break them down by timing, so it’s clear when cash actually leaves your account.

4. Account for Payment Timing and Terms

Cash isn’t always immediate. If customers take 30 days to pay, or if you buy inventory on credit, build those lags into your projection. Map when money truly arrives and departs, not just when it’s invoiced or billed. This step prevents blind spots that throw off your balance.

5. Calculate Net and Cumulative Cash Flow

For each period, subtract total outflows from total inflows to get your net cash flow. Add that to your starting cash balance to see your cumulative cash position. This tells you whether you’ll have enough to cover what’s due—or spot a shortfall before it hits.

6. Review and Adjust with Real Data

Projections can drift from reality, especially early on. Regularly compare projected numbers to your bank statements and actual results. Update your estimates as new information comes in, and adjust future periods so your projection reflects real business conditions.

Now that you have a working projection, let’s look at how you can sharpen its accuracy and stay ahead of surprises, keeping your cash flow insights sharp and useful.

Improving the Accuracy of Your Projections

Using Historical Data

Your past is the best place to start. Pull data from previous months—actual sales, customer payment patterns, and when bills went out and came in. These patterns highlight hidden ebbs and flows you might otherwise miss. The more detailed your records, the better your projections can reflect reality, rather than guesswork.

Factoring in Seasonal Trends

No business is immune to the seasons. Maybe your sales spike in summer or drop after the holidays. Map out these trends by month or quarter, using at least two years of your own data if possible. If your business is new, look for industry reports or talk with similar companies. Building these patterns directly into your projections helps avoid unwelcome cash flow surprises.

Adapting for Unexpected Changes

Plans are never set in stone. Customer tastes shift, supply costs rise, and new competitors arrive. Integrate a habit of ‘gut checks’: regularly compare your actual cash flow against what you projected. When you spot a mismatch, adjust your numbers going forward. This active, ongoing updating is what makes projections not just a plan, but a responsive tool.

Leveraging Automation and Tools

Manual spreadsheets can only take you so far. Cloud-based tools now connect with bank accounts and accounting systems, pulling in real-time data as invoices go out and payments clear. These platforms display trends visually, send alerts when balances dip, and can even run “what if” scenarios in seconds. Automating data flows also cuts down on typos and missed transactions that make projections unreliable.

The more accurate your projections, the more confidently you can act on them. Now that you know how to fine-tune your forecast, let’s see all these strategies in action with a simple template you can adapt for your business.

Practical Example: A Simple Cash Flow Projection Template

Downloadable Template and Walkthrough

Let’s say you run a small coffee shop and want to predict how much cash you’ll have each month. You don’t need fancy software to get started—just a basic spreadsheet will do. Here’s a pared-down example of the sections to include and what to enter.

1. Starting cash balance: Enter the money you have in the bank at the beginning of the month (for example, $2,000).

2. Cash inflows: List expected monthly income—say $5,000 from sales and $200 from event bookings.

3. Cash outflows: Include every predictable expense. This might be $1,800 for inventory, $1,200 for staff wages, $700 for rent, $250 for utilities, and $150 for marketing.

4. Net cash flow: Subtract outflows from inflows ($5,200 in, $4,100 out). Result: $1,100 net in the black.

5. Closing cash balance: Add your starting balance and net cash flow. If you began with $2,000 and added $1,100, you finish the month with $3,100. This amount carries over to the next month’s starting balance.

Most templates include these building blocks for each period—usually months. With this setup, you’ll quickly spot if your future months head into negative territory, giving you early warning to adjust your plans.

You can download a free template and plug in your numbers, adjusting rows for your specific income and costs. If your business is a service agency or an ecommerce store, just tweak the categories to fit your reality—remove “inventory” if you don’t have goods, or add lines for subscription platforms or shipping fees.

Customizing for Your Business Type

There’s no one-size-fits-all cash flow template. A restaurant might need separate entries for food and beverage purchases. A freelancer might focus on payment timings from recurring clients. Use the core categories above as a skeleton, then flesh out the details that match your operations.

As you get comfortable with the template, you’ll want to go beyond just filling in numbers and start interpreting what the trends mean for your business. Next, let’s turn these projections into smart, forward-looking decisions that help you navigate whatever comes your way.

From Numbers to Next Steps: Making Cash Flow Projections Work for You

Scenario Planning: Best, Worst, and Realistic Cases

After crunching the numbers, don’t just file away your cash flow projection—let it help you map out possible futures. Create three different scenarios: the best case if everything goes your way, the worst case for when challenges pop up, and the most likely case based on current trends. This exercise isn’t about guesswork; it’s about preparing for what your bank balance and receipts might look like if sales soar, dry up, or hold steady.

Adjust incoming and outgoing cash in each scenario. Maybe you land a major client, or perhaps your top supplier raises prices. By seeing how each change ripples through your cash flow, you get a better grip on what actions you’d need—whether it’s tightening up on spending, seeking short-term financing, or accelerating invoicing.

Using Projections for Decision-Making

Your projection isn’t a static spreadsheet—it’s a decision-making tool. Use it to spot gaps where expenses outgrow your income, so you can shift gears early. For example, if your worst-case scenario shows a potential cash crunch in three months, you can start conversations with lenders or negotiate longer payment terms now, long before cash gets tight. On the flip side, if your best-case projection leaves you with extra funds, you might plan an equipment upgrade or bulk inventory purchase that will save money in the long run.

Review your forecast regularly and compare it to actual figures. Use any gaps to refine your process, question your assumptions, and keep your next steps rooted in reality. Smart, timely decisions are built on this habit of checking where your cash is expected to go—and making tweaks before problems snowball.

Of course, knowing what to do with your numbers is one thing—answering the practical, everyday questions about managing projections is another. Let’s tackle the most common issues business owners face with cash flow forecasts.

Frequently Asked Questions on Cash Flow Projections

How often should I update my cash flow projection?

Monthly updates work for most businesses, but if your income and expenses change a lot, weekly reviews give you a better handle on surprises. Consistent updates make your projections trustworthy and keep you from flying blind.

What if my projections are always off?

If your numbers regularly miss the mark, it’s a sign your assumptions might be off. Check whether you’ve overestimated sales or underestimated costs. Comparing projected figures with real results can help you fine-tune so future forecasts land closer to reality.

Can software really help with cash flow projections?

Yes. Spreadsheets can do the job, but software built for cash flow projections saves time and cuts down on errors. Automation pulls in your bank transactions, updates figures in real time, and lets you test “what-if” scenarios with a few clicks.

Armed with answers to the most common questions, you’re ready to move from theory to practice and see firsthand how cash flow projections come together for your business.