Compare best Pitchbook alternatives for fundraising and investor outreach.

| Feature | EasyVC | Foundersuite | PitchBook | CB Insights | Tracxn | Dealroom | AngelList | Kaspr | Crunchbase | Visible VC | OpenVC |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AI‑based investor matches | Yes | No | No | No | No | No | No | No | No | No | Yes |

| LinkedIn outreach automation (Chrome extension) |

Yes | No | No | No | No | No | No | Yes | No | No | No |

| 1‑on‑1 coaching sessions | Yes | No | No | No | No | No | No | No | No | No | No |

| CSV data exports of investor lists | Yes | Yes | Yes | Yes | Yes | Yes | No | Yes | Yes | Yes | No |

| Full access to investor contact details | Yes | Yes | Yes | Yes | No | No | No | Yes | Yes | No | No |

| Fundraising AI chatbot | Yes | No | No | No | No | No | No | No | No | No | No |

| Investor database (manual search) | Yes | Yes | Yes | Yes | Yes | Yes | No | No | Yes | Yes | Yes |

| Complete investor‑pipeline workflow | Yes | Yes | No | No | No | No | No | No | No | Yes | No |

Pitchbook is a great tool to gather market intelligence, but if you are a founder raising for your company the tool can be very expensive, with many features that don’t add value to your funding round, and a very complex UI with data you don’t probably need.

Your goal raising for your startup is to follow a process, find the right investors for your company, and find a huge number of them (around 100) so you can get a good chance of raising your round. That’s it.

So if you’re questioning whether Pitchbook is the right option for your company this list is for you. Let’s take a look at the top 10 Pitchbook alternatives, starting with one that’s rapidly becoming the favorite option for founders.

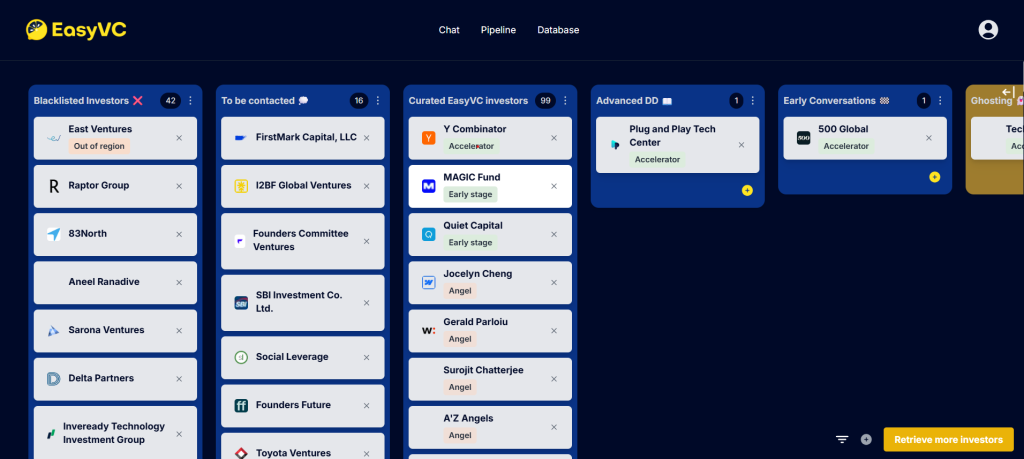

1. EasyVC

EasyVC is the most founder-friendly alternative. EasyVC helps you finding investors with AI and creating warm intros campaigns by helping you find founders of their portfolio to reach out to them through LinkedIn and build your network for your funding round.

Here’s what you get on the free trial:

- Investor sample of 6 investors

- Access to the general information section of each investor and the portfolio founders Pipeline

- Access to our Chrome Extension to automate LinkedIn outreach

Built for founders that realized Cold Email doesn’t help getting investor meetings.

EasyVC Pricing

- Free Trial: $0

- Monthly Plan: $119.99/month

- Annual Pro Plan: $89.99/month (billed annually)

EasyVC Reviews

Loved by hundreds of founders coming from different industries:

- Gaming

- Biotech

- Proptech

- PetTech

- EdTech

- Hardware

- Metaverse

- Web3

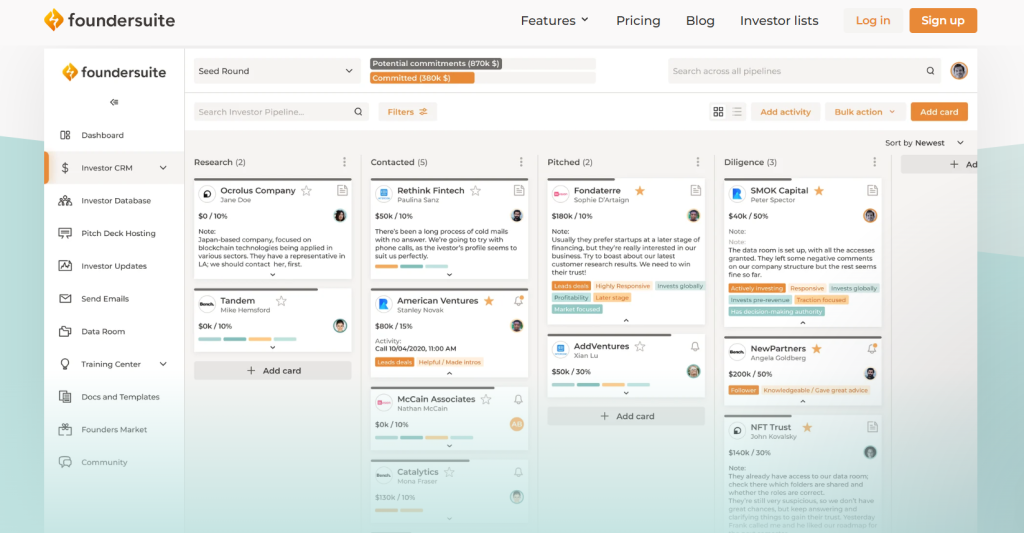

2. Foundersuite

Website: foundersuite.com

Foundersuite has a broad database of investors. However, doing research of a database of thousands of investors can feel like eating an elephant with a tea spoon. Industry filters and manual search can take hundreds of hours of your time without actually making any progress in your funding round.

Foundersuite Limitations

- Investor outreach: After finding the right investors, Foundersuite doesn’t help you get the meetings with them knowing the investor’s psychology. It offers a tool to send cold emails to investors, entry path that doesn’t build trust right from the start.

- Limited “Get Intro” Feature: Finding potential intro paths from your existing connections can help you find 2 or 3 convenient introductions. To raise a funding round, you’ll need dozens of warm introductions. This is only built by cold outreaching other founders that have raised from your target investors.

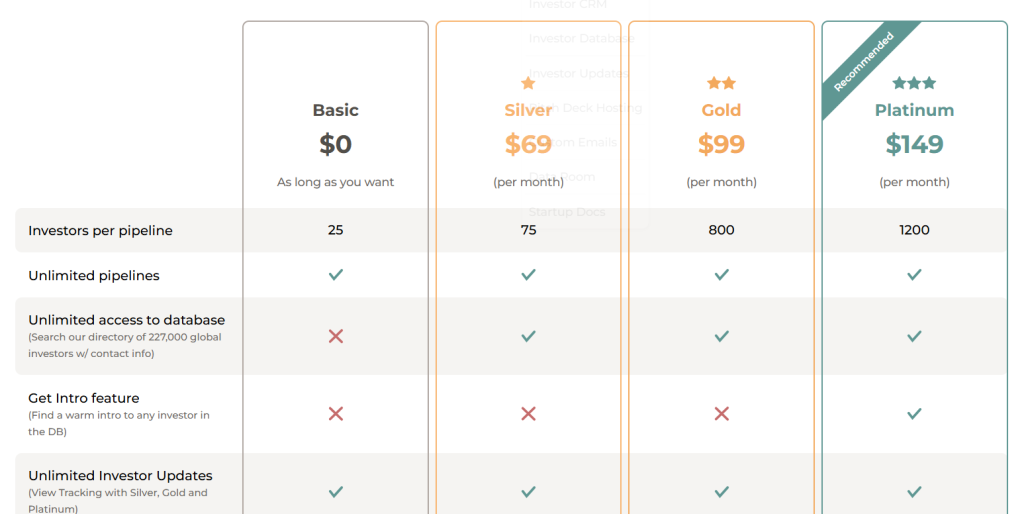

Foundersuite Pricing

- Basic: $0

- Silver: $69/month

- Gold: $99/month

- Platinum: $149/month

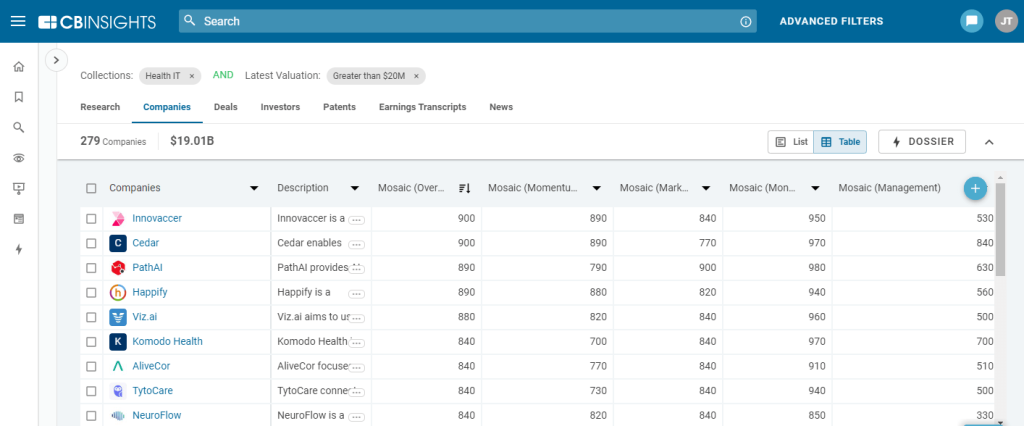

3. CB Insights

Website: cbinsights.com

CB Insights can be a useful market data tool. However, their services are project-based with expensive pricing based on seats. This tool is not accessible to many investors and founders, plus, it doesn’t automate investor or company research nor helps automate investor outreach.

CB Insights Limitations

- No investor outreach

- No automated AI research

- High-price licenses

- Complex UI

CB Insights Pricing

CB Insights Pricing is not publicly shared. However, users have shared that the platform starts at $60,000 per year with plans going up to as much as $265,000 for an all-inclusive “insider” package.

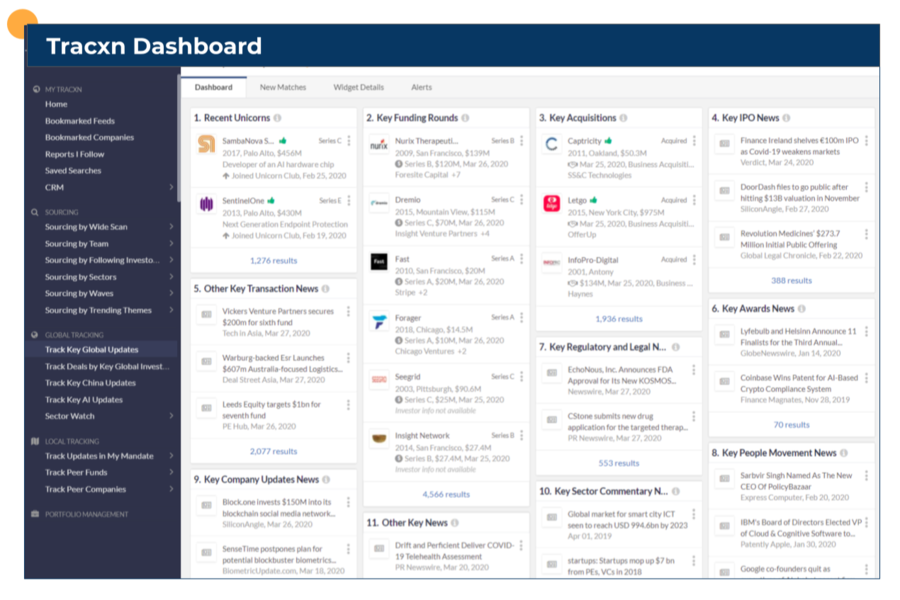

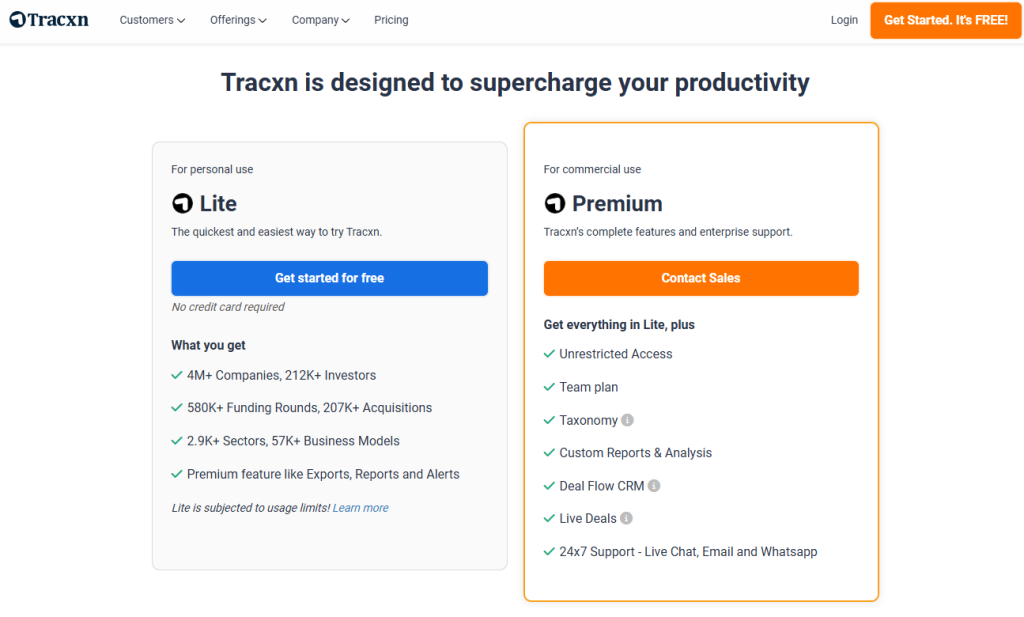

4. Tracxn

Website: tracxn.com

Tracxn is a wide database of companies and investors that can be helpful for data analysts and researchers, but not for founders that need to quickly find a great volume of investors that could be a great match for their company, and build a pipeline of introductions.

Tracxn Limitations

Investor outreach: After finding the right investors, Tracxn doesn’t provide contact information of investors, nor does it help you get the meetings with them through the right investor’s psychology. It is a high-price tool that doesn’t help founders raise rounds.

Tracxn Pricing

Even though Tracxn doesn’t show their pricing publicly, users have confirmed they have a $500/month license and a usage-based pricing for data usage.

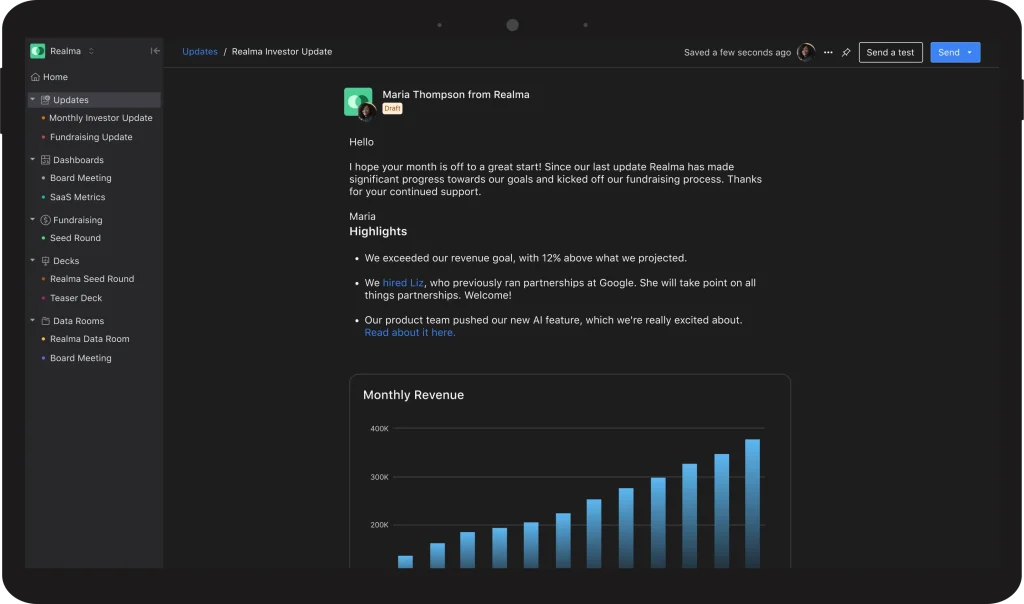

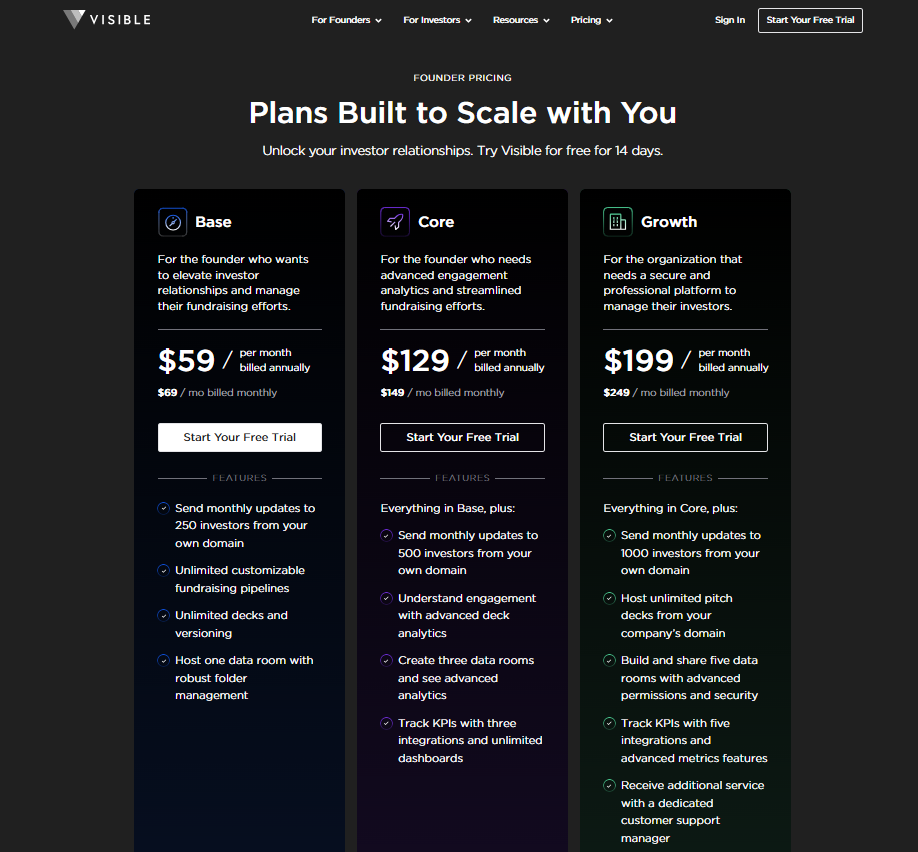

5. Visible.vc

Website: visible.vc

Visible.vc is a good software for managing and updating investors. However, the interface has a big number of features that doesn’t help raising from investors, which makes the tool hard to understand and does not help at the core of your fundraise.

Visible.vc Limitations

Focus on investor reporting: Visible.vc is a platform framed to help VCs managing their portfolio and Founders managing their current shareholders and relations. Their pricing plans are built around investor updates and their features are not focused on helping founders find the right investors and build a fundraising pipeline.

Limited tools to help founders raise: Their tools don’t help automate investor outreach and pipeline building. It can help automate sending report emails, something that can be done for free with email tools and email lists.

Visible.vc Pricing

- Base: $59/month

- Core: $129/month

- Growth: $199/month

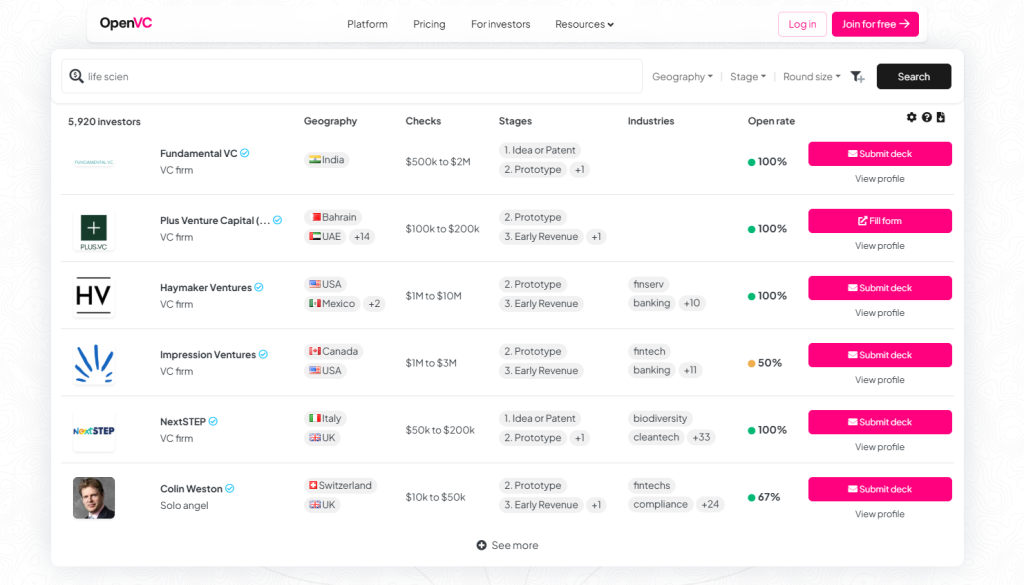

6. OpenVC

Website: openvc.app

OpenVC is a free tool that needs to be upgraded to the paid plan to really start making progress in your funding round, unlocking more than 1 investor outreach per day. Their platform is an opt-in database, meaning that you’ll be limited in your investor research to the ones with whom OpenVC has partnered with, leaving many opportunities on the table.

OpenVC Limitations

Free plan is just a limited investor database: Doing investor research manually is extremely time-consuming for founders. Limiting the size of your search can limit your investment opportunities.

OpenVC is another cold channel: Investors that receive outreach from another platform is the same as receiving cold emails. Founders need to build authority and trust right from the start with any new investor interaction with warm introductions. OpenVC doesn’t help with building a network of warm introductions from scratch.

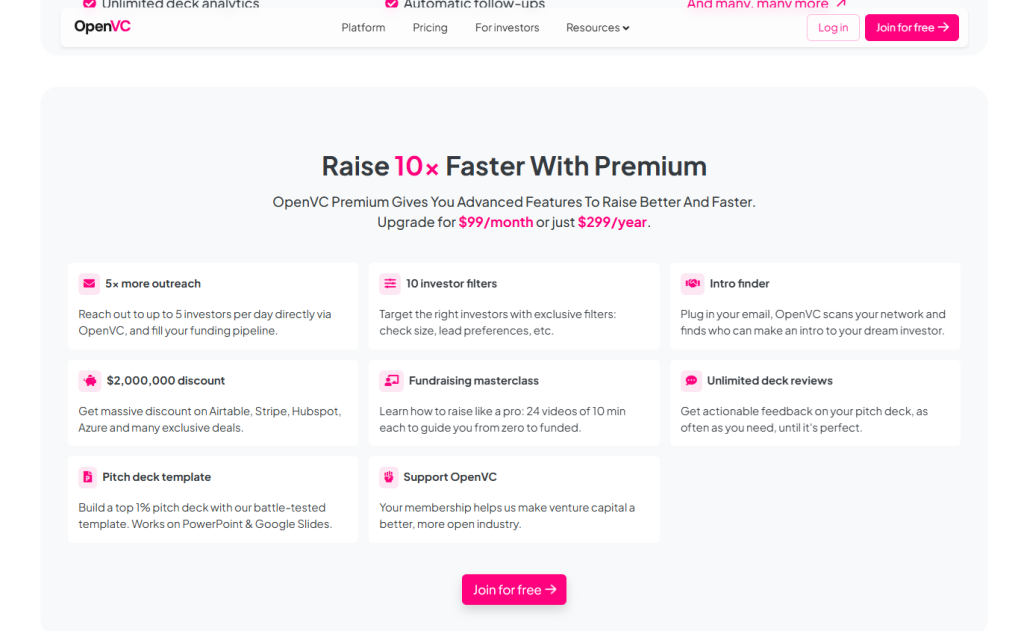

OpenVC Pricing

- Free Plan: $0 (1 investor outreach per day)

- Premium Plan: $99 (5 investor outreaches per day)

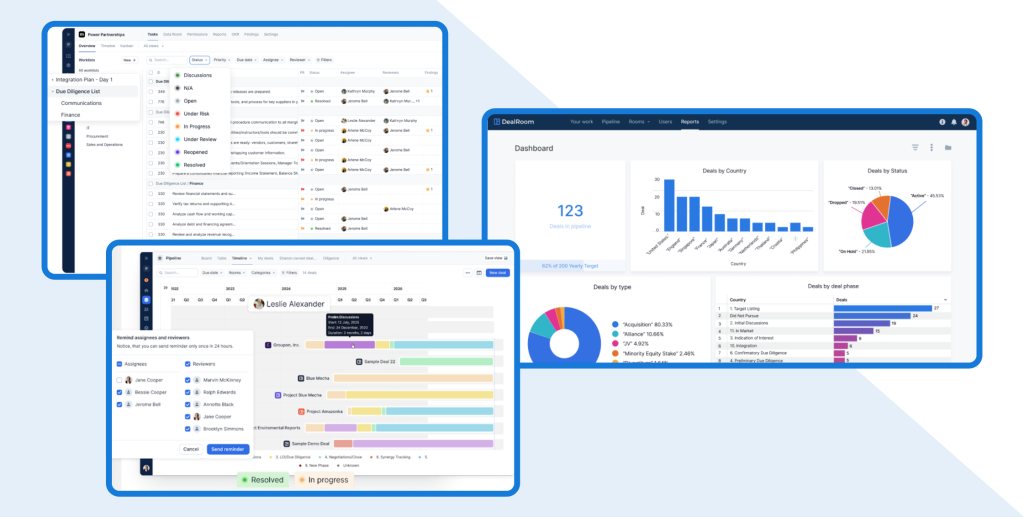

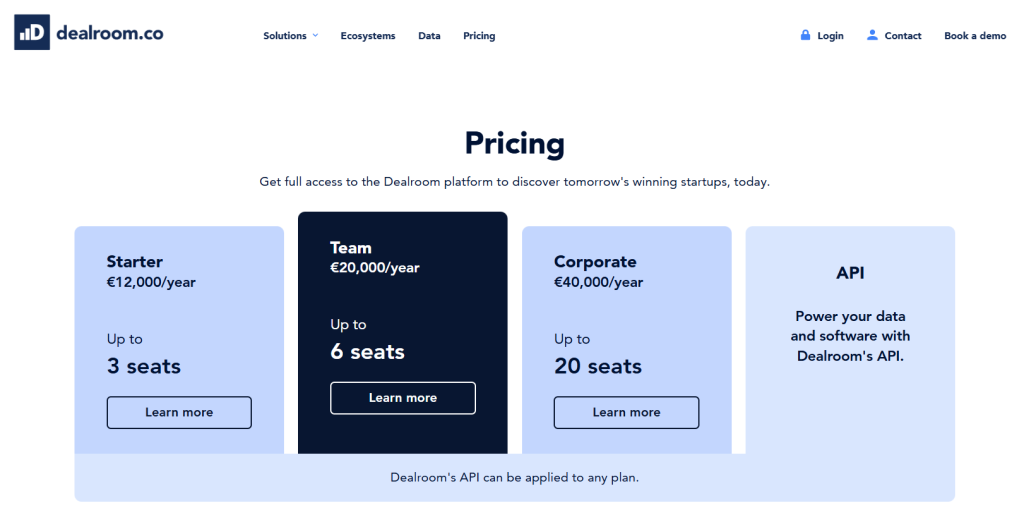

7. Dealroom

Website: dealroom.co

Dealroom is a database of companies and investors. It can provide information about investors and contact details but is also framed to be used as a recruiting and PR pipeline. It is a tool that cane be more suited for companies with +100 employees where several tasks related to research can be achieved.

Dealroom Limitations

High-price licenses not accessible to startups: Their prices range from €12,000 to +€40,000 a year. Founders looking to raise capital from investors don’t have access to these licenses.

Manual investor research: Like all the other tools listed, it relies on the founder’s time to do the manual research in the database. Consuming time that is not dedicated to fundraise.

No help in investor outreach: Dealroom doesn’t provide a great way to get investor meetings in their platform.

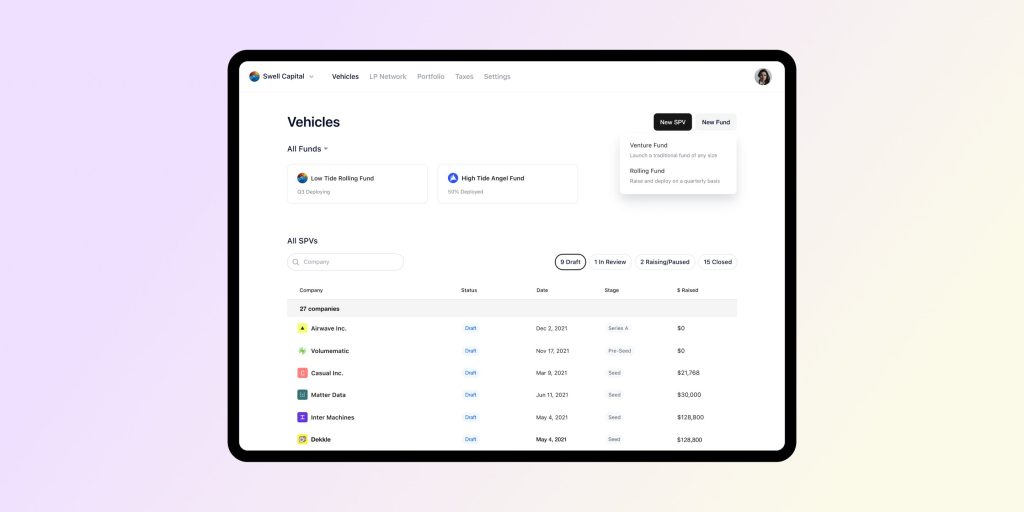

8. AngelList

Website: angellist.com

AngelList is a platform with a set of tools to help founders in many aspects, from incorporation, to legal aspects, to fundraising, lacking focus on the important aspects of the funding round such as investor research, outreach automations and tracking your fundraising pipeline.

AngelList Limitations

Multi-purpose platform: AngelList is a platform dedicated to help founders in several aspects of incorporating the company, not specifically focused on raising from private investors and Venture Capitals.

High pricing: The license for the services is not widely accessible and doesn’t tackle one of the main challenges of any founder, raising from investors.

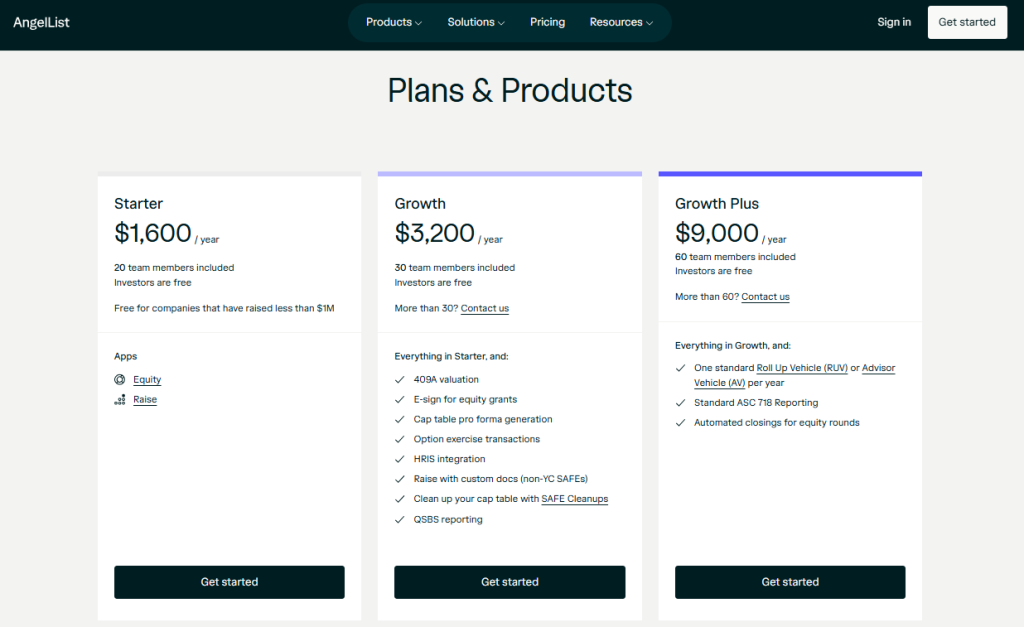

AngelList Pricing

Starter: $1,600/year

Growth: $3,200/year

Growth Plus: $9,000/year

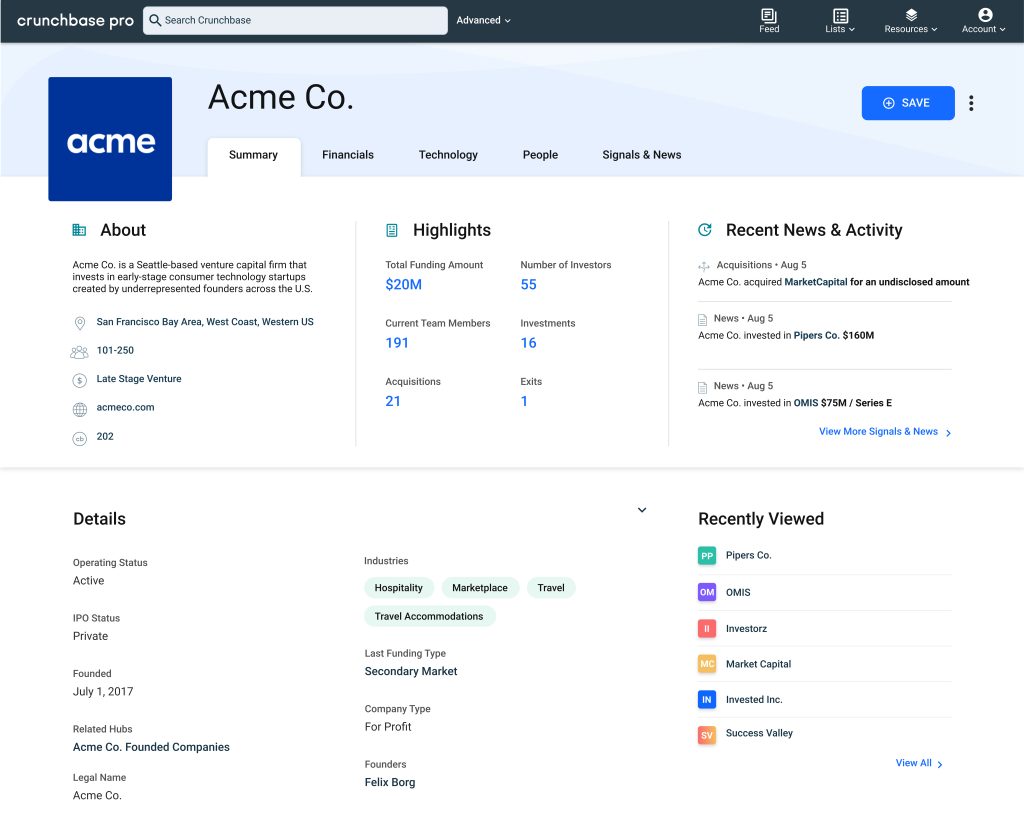

9. Crunchbase

Website: crunchbase.com

Crunchbase is a good database to search information about investors, startups and funding rounds. However, you have to manually do the research and you don’t get the investor’s contact information. The interface has a big number of features that don’t help raising from investors, making the tool hard to use and not helping at the core of your fundraise.

Crunchbase Limitations

Wide database without tools to help founders: Crunchbase is a more suitable solution for data analysts and market researchers. It has a great dataset of companies and investors, but finding the right investors in Crunchbase is like finding a needle in a haystack.

No investor outreach automation: Crunchbase is a database, not a fundraising tool.

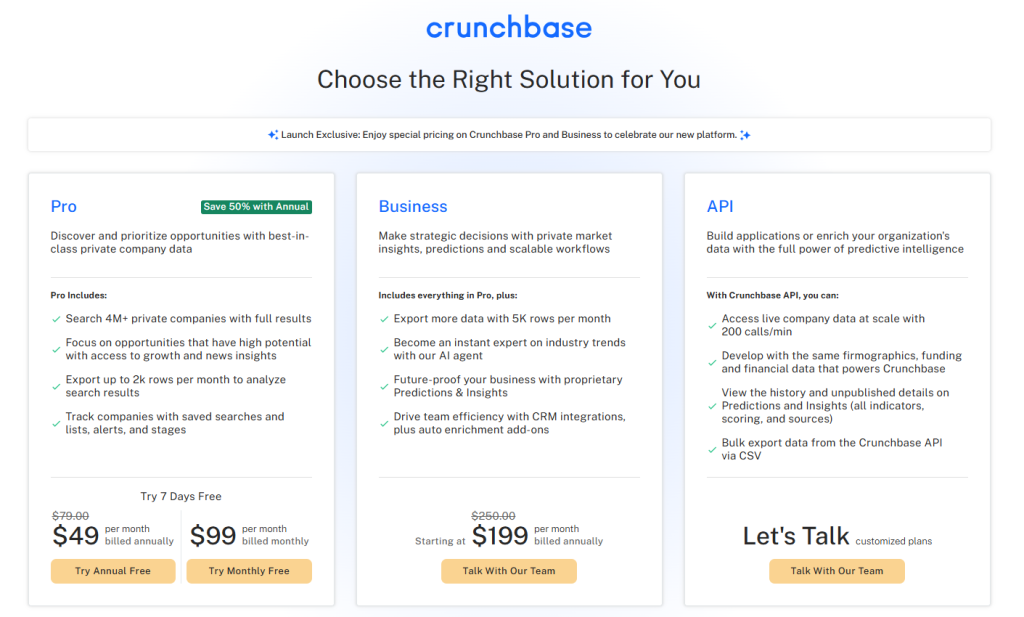

Crunchbase Pricing

- Pro: $99/month

- Business: $199/month

- API: High-price license for custom project

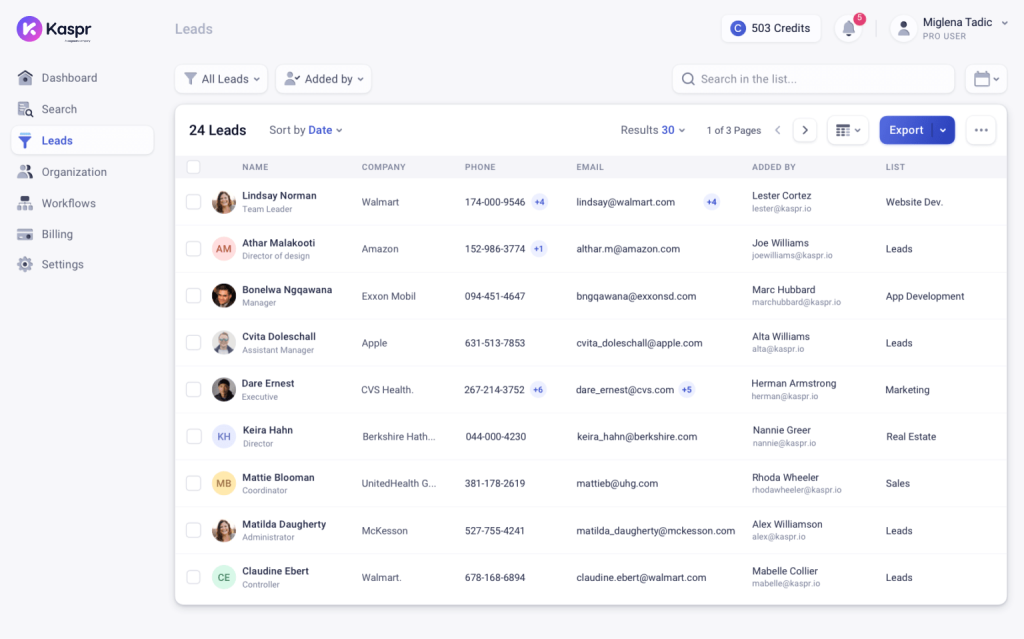

10. Kaspr

Website: kaspr.io

Kasprs a great CRM tool that helps automating outreach, but lacks focus on the fundraising niche. Information in the database and the features are built around helping companies in their sales pipeline.

Kaspr Limitations

Data not focused on investor outreach: The data is a broad dataset of companies, not built around helping founders find investors.

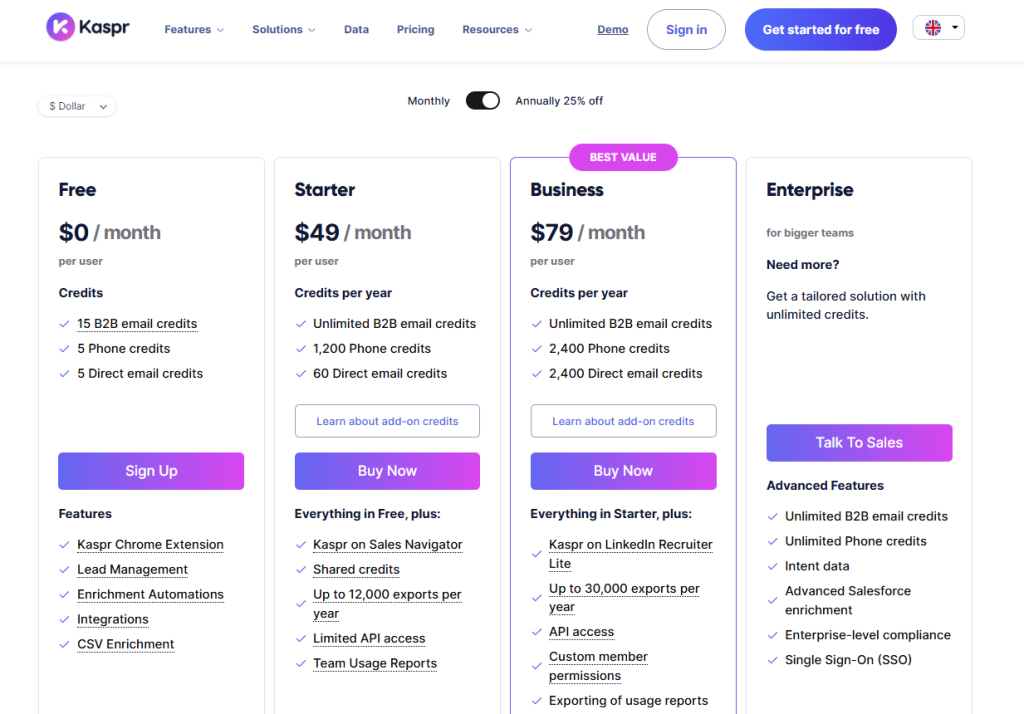

Kaspr Pricing

- Free: $0/month

- Starter: $49/month

- Business: $79/month

- Enterprise: Custom License

What is the best alternative to Pitchbook?

EasyVC is rapidly becoming a cult favorite in early-stage circles. Helping founders where they really need support, saving time researching investors and closing meetings with them.

Automated Investor Research thanks to AI: EasyVC uses AI to match startups with relevant investors from a database of over 50,000 VCs and angel investors. Users input details about their company, and the system returns a curated list of matches based on fit and relevance, helping reduce the time spent on manual research.

LinkedIn Outreach Automations: With EasyVC’s Chrome extension, users can automate LinkedIn outreach to portfolio founders of target investors. This functionality is designed to streamline the process of securing warm introductions, which can increase the chances of a response.

Cost-Effective: Compared to traditional consulting or manual research, EasyVC offers a set of tools at an accessible monthly rate. Both monthly and annual plans include AI matching, contact access, and workflow management features, which may help users reduce external costs or time investment.

Chatbot: A built-in fundraising chatbot is available to assist with common questions and next steps. It draws from a database of fundraising knowledge to provide responses relevant to different stages of the investor outreach process.

User-Friendly Fundraising Pipeline: EasyVC includes a drag-and-drop investor pipeline to help users organize and manage outreach, follow-ups, and investor conversations. Users can tag investors, track status, and centralize communication history within a single interface.