Understanding Annual Recurring Revenue (ARR)

In today’s rapidly evolving subscription-based economy, understanding the nuances of financial metrics is essential for businesses aiming to achieve sustainable growth. Among these critical metrics, Annual Recurring Revenue (ARR) stands out as a cornerstone for evaluating the health and forecast of subscription businesses. ARR provides a clear picture of the predictable revenue streams that a company can expect on an annual basis, stemming from its active subscriptions. As more companies transition to recurring revenue models, the importance of comprehensively grasping ARR cannot be overstated. This foundational knowledge not only aids in effective financial planning and strategy but also fosters informed decision-making that drives business expansion and stability. Join us as we delve into the intricacies of ARR, exploring its definition, calculation, and strategic significance in propelling your business towards unyielding success.

What is Annual Recurring Revenue (ARR)?

Definition and Components of ARR

Annual Recurring Revenue (ARR) is a key metric used by subscription-based businesses to predict and analyze their yearly revenue derived from recurring transactions. It provides a clear picture of the income generated by ongoing subscriptions, which is crucial for assessing the financial health and growth potential of a company.

ARR is composed of several elements, including the revenue from all active subscriptions, upgrades, and renewals, as well as any applicable discounts or deductions that apply over a year. It excludes any one-time fees or transaction-based revenues.

Importance of ARR in the Subscription Economy

ARR holds significant importance in today’s subscription-driven economy as it offers insights into the stability and viability of a business model centered on recurring transactions. It serves as a predictor of future cash flows, enabling companies to make informed strategic decisions regarding investments, expansions, and operations. By analyzing ARR, businesses can better understand their retention rates and customer loyalty, thereby facilitating targeted efforts to enhance their offerings and competitive positioning.

Having a solid grasp of ARR not only aids in managing investor expectations but also in evaluating the effectiveness of sales and marketing strategies. For companies relying on a subscription model, a strong ARR is indicative of a loyal customer base and sustainable business growth. As we proceed, we’ll explore how to calculate this crucial metric.

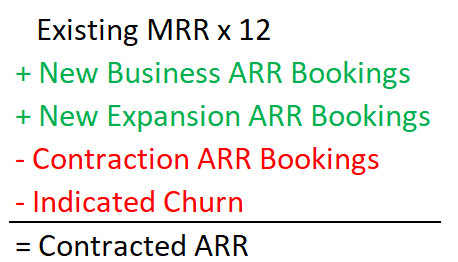

How to Calculate Annual Recurring Revenue

Basic ARR Formula

Annual Recurring Revenue (ARR) is an essential metric for subscription-based businesses, as it provides a clear picture of the company’s predictable revenue over a year. The basic formula to calculate ARR is straightforward. Here it is:

To calculate ARR, multiply your Monthly Recurring Revenue (MRR) by 12. This gives you the yearly revenue generated from subscriptions, excluding any one-time fees or non-recurring revenue. The formula is as follows:

ARR = MRR x 12

Inclusions and Exclusions in ARR

When calculating ARR, it’s vital to include all sources of recurring revenue, such as regular subscription fees and any recurring add-ons or upgrades. However, do not include one-time charges, setup fees, or any short-term promotions that do not extend beyond a year. By ensuring consistent application of these principles, you will maintain the accuracy and reliability of your ARR figures.

Common Calculation Mistakes to Avoid

One frequent error when calculating ARR is including non-recurring revenue, which leads to inflated figures. Another common mistake is failing to account for churn, which can significantly impact the growth forecasts based on ARR. Therefore, always adjust your ARR calculations to reflect both churned and acquired customers accurately.

Understanding how ARR intersects with other financial metrics can offer a more well-rounded overview of your company’s performance. In the next section, we’ll explore how ARR compares to other important financial indicators.

ARR vs. Other Metrics

ARR vs. MRR: Key Differences

Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR) are both crucial metrics in the subscription-based business model, but they serve different purposes. ARR provides a long-term view of a company’s subscription revenue on an annual basis, making it easier for stakeholders to understand the business’s stability and growth potential over a year. In contrast, MRR is focused on the short term, offering insights into the monthly recurring income, which is vital for monitoring immediate changes and monthly trends in revenue.

ARR vs. Total Revenue

While ARR is restricted strictly to the recurring revenue portion of a business’s income, total revenue encompasses all kinds of revenue streams, including non-recurring elements like one-time sales, professional services, and other non-subscription income. This makes ARR a more focused measure to gauge the health and growth trajectory of subscription revenues specifically, whereas total revenue provides a broader picture of a company’s overall earning capacity.

Comparing ARR with Churn and Growth Rates

ARR is an indication of revenue stability and growth, but it needs to be evaluated alongside churn and growth rates to provide a complete picture. Churn rate, which measures the percentage of customers or revenue lost over a period, directly affects ARR. Maintaining a low churn rate is just as crucial for ARR growth as attracting new business. Similarly, examining ARR in conjunction with growth rates helps to assess how effectively a company is scaling its subscription services. For more information on churn rates, you can refer to our post on churn rate meaning.

By understanding how ARR compares and contrasts with other key performance indicators, businesses can make more informed strategic decisions. Now, let’s explore some effective strategies to maximize ARR and ensure long-term growth and success in the subscription economy.

Strategies to Maximize Annual Recurring Revenue

Improving Customer Retention

Retaining existing customers is a cornerstone strategy to enhance ARR. Focusing on building strong customer relationships through excellent service and engagement can significantly reduce churn rates. Implementing personalized customer support and leveraging customer feedback can help address issues proactively, ensuring satisfaction and loyalty. Understanding churn rate meaning is essential in this process.

Upselling and Cross-Selling Opportunities

Maximizing the value of existing customers through upselling and cross-selling is crucial for ARR growth. By offering complementary products or premium service tiers that add value, businesses can increase average revenue per user. Understanding customer needs and purchasing behaviors allows for more tailored recommendations, enhancing the likelihood of upgrades.

Innovative Pricing and Packaging

Innovative pricing strategies and packaging can attract diverse customer segments. Offering tiered pricing models, bundled services, or flexible subscription plans adds versatility, catering to different customer needs and budgets. Regularly reviewing and adjusting pricing strategies can also ensure competitiveness in a dynamic market.

With these strategies in place, businesses can effectively maximize their ARR, contributing to sustained growth and profitability. However, navigating potential challenges is equally important, as missteps can impact revenue objectives. Thus, understanding common pitfalls in ARR management will provide additional insights into strengthening business operations.

Common Pitfalls and Challenges in ARR Management

Overestimated Growth Forecasts

One of the most common pitfalls in ARR management is overestimating growth forecasts. Companies often fall into the trap of projecting overly optimistic growth rates without considering factors such as market conditions, competitive pressures, and potential economic downturns. Overly ambitious forecasts can lead to misguided investments and strategic misalignments.

Underestimated Customer Churn

Customer churn is a critical factor that can significantly impact ARR. Underestimating churn rates can lead to unrealistic revenue projections and inadequate resource allocation for customer retention strategies. It’s essential to closely monitor churn rates and understand the underlying reasons behind customer attrition to improve retention efforts. For insights on managing churn, check our article on churn rate meaning.

Navigating Market Competition and Saturation

The subscription economy is growing rapidly, leading to increased market competition and saturation. Companies might struggle to differentiate their offerings and maintain customer loyalty. To navigate this challenge, businesses need to continuously innovate and improve their products and services to stay ahead in a competitive landscape.

Understanding these pitfalls is crucial for effective ARR management. As we delve into the complexities of ARR, it becomes important to explore strategies that can help businesses maximize their recurring revenue streams. By doing so, companies can better position themselves for sustainable growth and success.