Decoding the Startup Fundraising Finders Fee: A Comprehensive Guide

When you’re on the journey to secure funding for your startup, you might come across a concept known as the startup fundraising finders fee. What should you expect from a fundraising advisor and what’s normally the fees they charge between percentages and retainers? We’ll cover all these here.

How Much is a Startup Fundraising Finders Fee?

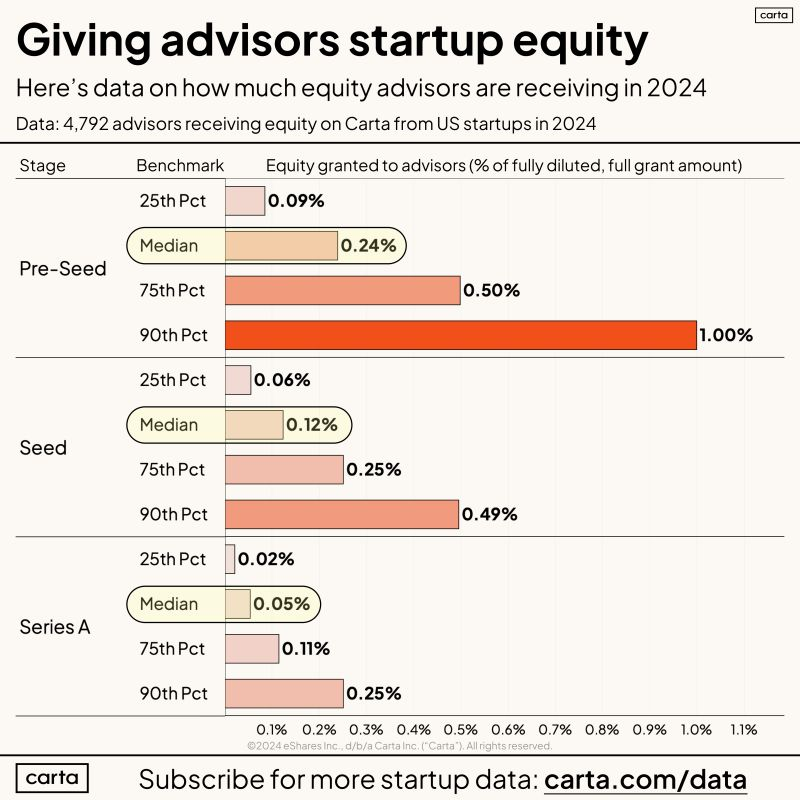

A finders fee, sometimes referred to as a referral fee, is a commission paid to an intermediary who helps a startup secure investment. This intermediary, or ‘finder,’ can be anyone from a professional fundraising consultant to a well-connected individual who introduces you to potential investors. According to Carta, these are the medians of deals closed between advisors and startups:

As you can see here, depending on the fundraising stage, it can vary between 0.24% for earlier stages, to 0.05 for more developed stages (Series A onwards).

Is an Advisor Important and Should I Pay a Finders Fee?

Maybe you needed to know general benchmarks about what’s the current market price for startup advisors. But the root question would be, are advisors a good play for my board? From our own experience raising as founders and having more than 7 different advisors, the total amount of money raised from advisors was $0. Advisors can be relevant if they are a relevant person in your industry, but in order to raise a round, you need to follow a process that involves building trust with investors. Having an intermediate between you and the investors may seem as a good play, but at the end of the day, investors invest in the founding team, so having a intermediary makes things more difficult.

If you want to know more about how to conduct a proper process, here’s the playbook we followed to raise $4M for our previous company, and a step-by-step guide here.

Legal Considerations

While a finders fee can be a useful tool in your fundraising arsenal, it’s crucial to be aware of the legal implications. In many jurisdictions, anyone who receives a fee for helping secure investment must be a registered broker-dealer. If they’re not, both you and the finder could face legal consequences. Always consult with a legal professional before entering into a finders fee arrangement.

If you’re considering how to find investors for startups, ensure that your approach is compliant with legal standards to avoid pitfalls.

Thank you for reading EasyVC’s blog!

Are you looking for investors for your startup?

Try EasyVC for free and automate your investor outreach through portolio founders!

Maximizing the Value of a Finders Fee

To get the most out of a finders fee arrangement, it’s important to choose your finder wisely. Look for someone with a proven track record in your industry and a strong network of potential investors. Remember, you’re not just paying for an introduction; you’re paying for their expertise and guidance throughout the fundraising process.

Is a Finders Fee Right for Your Startup?

Deciding whether to use a finder and pay a finders fee is a decision that should be made carefully. Consider your current fundraising strategy, the potential investors in your network, and the amount of funding you need to raise. If you’re struggling to connect with investors or need a significant amount of capital, a finders fee could be a worthwhile investment.

Conclusion

Understanding the startup fundraising finders fee can help you make informed decisions about your fundraising strategy. While it’s not the right choice for every startup, it can be a valuable tool for accessing new investors and accelerating your fundraising process. As always, make sure to consult with a legal professional before entering into any agreements.