Financial Projection Template for Startup for Your Fundraising Journey

Being able to quickly know your current cash position as a startup founder can make or break your company. The founders of EasyVC have built several companies, raised $4M from Venture Capitals, and managed companies with $100K burn rate. This template is the one we’ve used on a daily basis to really know what’s going on with your cashflow.

Why Financial Projections Matter for Startups

As entrepreneurs, we need financial projections that are easy to understand, even for founders without a financial background. Clear financial projections help you comprehend your business’s financial health at a glance, covering key areas like Payroll, Tech, Partners, and Marketing costs, and how these affect your cash flow.

Not having a solid financial projection template can lead to poor judgment and unexpected cash shortages, impacting your runway (how long your company can stay operational). These projections serve as your startup’s financial roadmap, guiding you through your business journey’s ups and downs. Here’s why they are crucial:

1. Attracting Investors

Investors want to see a clear, realistic financial plan. It shows that you understand your market, costs, and revenue potential. Detailed financial projections can set you apart from other startups seeking the same funding. For insights on how to attract investors, consider reading how to find investors for your business.

2. Strategic Planning

Financial projections help you plan for the future, allocate resources efficiently, and make strategic decisions. They provide insights into when to scale, hire, or pivot. Understanding these strategic elements is crucial, much like mastering scalable startup entrepreneurship.

3. Tracking Progress

Regularly updating your financial projections allows you to track your progress against goals, helping you stay on course and make necessary adjustments. This is similar to how you might track retention rate formula in terms of churn.

Introducing the Simple Financial Projection Template

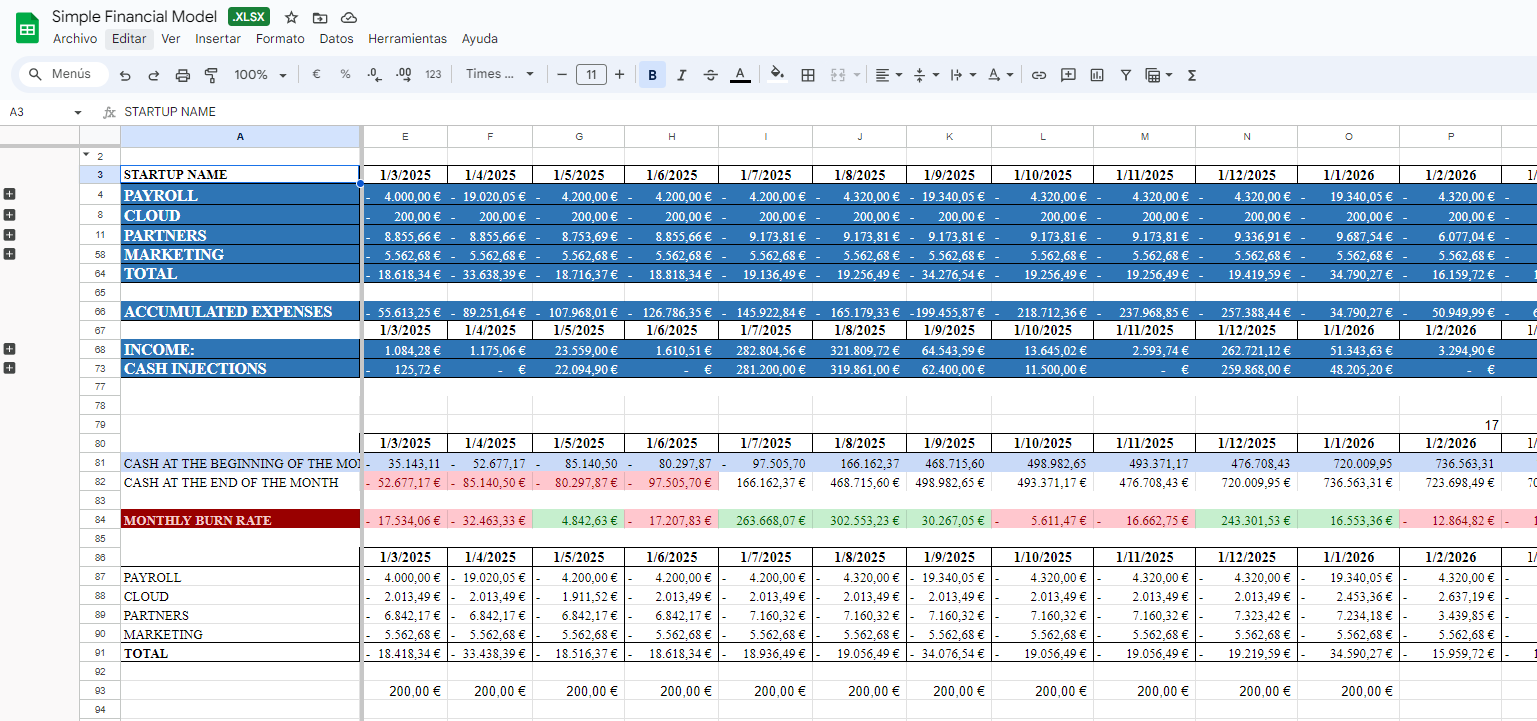

Meet the Simple Financial Projection template—your new best friend in financial planning. This comprehensive tool is designed to project and analyze the financial performance of your startup over five years, from December 2024 to December 2029. Here’s what makes it a must-have:

Key Components of the Template

- Payroll: Track detailed monthly expenses for each role within your startup, ensuring you manage salaries effectively.

- Cloud: Monitor costs associated with cloud services and infrastructure, with providers like Google Cloud or AWS.

- Partners: Record expenses related to tech partners and operations, including VAT.

- Marketing: Break down your marketing expenses into campaigns, social media, PR, advisors, and other marketing-related costs.

Monthly Data

Each month from December 2024 to December 2029 is represented as a separate column, offering a granular view of your startup’s financial activities. You’ll see both fixed and variable costs, total expenses, and more.

Annual Summaries

At the end of each year, the template calculates annual totals, giving you a broader perspective on your startup’s financial health. These summaries include total expenses for each category, helping you compare year-over-year performance.

Income and Cash Injections

Income: Project revenue streams, including one-time sales, subscriptions, VAT, and user contributions.

Cash Injections: Record grants, capital increases, and other financial inputs to support your startup’s growth and operations.

Accumulated Expenses

Keep a running total of expenses over time, providing a clear picture of your startup’s financial commitments and burn rate. Learn more about managing expenses through tools like cap tables.

Monthly Burn Rate

The template calculates your monthly burn rate, highlighting the cash outflow each month. This is critical for understanding how quickly you’re spending your capital.

Cash Position

Track your cash at the beginning and end of each month to ensure you have sufficient funds to cover your expenses.

Thank you for reading EasyVC’s blog!

Are you looking for investors for your startup?

Try EasyVC for free and automate your investor outreach through portolio founders!

Why Customizability Matters

The Simple Financial Projection template is highly customizable, allowing you to add or modify categories and data to suit your specific needs. This flexibility ensures that the template can grow and evolve with your startup.

Comprehensive Tracking

By providing monthly data, the template ensures that no expense or revenue is overlooked. This accuracy is crucial for forecasting and budgeting. For more on comprehensive tracking, consider reading about cap table templates in Excel for new funding rounds.

Annual Projections

Annual summaries help you make long-term financial decisions and assess your startup’s overall performance.

Get Your Free Financial Projection Template

Ready to take your financial planning to the next level? Access your free Simple Financial Projection template here: Download the Template.

This resource is part of our full data room resource, in case you’re raising from investors.

Conclusion

A well-crafted financial projection template for startup is an invaluable tool in your fundraising journey. It provides clarity, attracts investors, and helps you make strategic decisions. With the Simple Financial Projection template and EasyVC by your side, you’re well-equipped to navigate the complex world of startup funding. Download the template today and take the first step towards financial clarity and successful fundraising.