How to Attract Investors for Your Startup the Right Way

It’s not easy to have a strong network of investors. When you’re out in the market trying to get meetings with them, most of the common advice out there (LinkedIn, Substack, Medium, etc) is that you should “ask for warm intros from people of your network”. Which pretty much means going on LinkedIn and seeing if any of your connections is also connected with an investor you’re targeting.

But for me, as a founder, I always thought ‘‘Yeah…! Of course! I’m sure one of my former colleagues in banking/consultancy/university will have a lot of connections and, sure, will be a killer intro with Sequoia Capital…!’’

I think I don’t need to extend the joke further to get my point across. Founders with no network in the startup ecosystem can’t use that playbook. Even founders who have an existing network will find that network is always limited. In my last funding round, I already had 3 VCs in my cap table, and they had their respective network of investors with whom they shared boards, dealflow and connections.

But again, my VCs had a “limited” number of good intros they would make. Assuming that each can make 7 warm intros, that’s 3×7 intros = 21 intros. Great! Now I have 89 VCs left in my fundraising target list with whom I still don’t have a direct intro path.

As you can see, this playbook, which has been repeated over and over, is a nice-to-have strategy to save time and get very effective interactions with investors. However, if you really want to have real chances of raising capital, this is not going to be enough.

So how do you build a system where you can get +100 warm intros? Well, you create them by doing cold outreach to founders in the investors’ portfolio.

How to structure a funding round the right way

Why is it important to follow a process where you build Density of meetings?

Early stage investors will invest in founders, period. You’ve probably heard hundreds of times investors telling you “You’re too early” or “when you have more revenue we’ll be ready to invest”. This is just another VC tactic to kick the can forward. In early stage investments, there is no empirical data that will prove that a company will become the next Facebook, and trust me, Venture Capital is a financial play purely focus on finding the next Facebook, not just an “ok” company. Therefore, you need to build a story with incredible returns, but in order to set the right environment to make your story believable, you need to build external Authority.

How do you build authority around your funding round?

In order to build a strong foundation around your story, you need to make investors see that there is market validation. When I say market validation, I mean validation in the “investor market”. For investors, seeing fellow peers interested in your deal is the best way you can build authority. If there are other investors interested in your company, at least it might be worth taking a deeper look.

External validation equals authority, and authority makes your story great

Once you have investors interested, you need to have a pitch that makes them want to jump onboard. In order to build a story that makes VC investors take the leap, we recommend you to read “The Black Box of Venture Capital“ by Floodgate. In summary, you have to build a story that:

- Focuses on the size of outcome if successful, rather than the probability of success.

- Is a vehicle for the delivery of emotions, not of facts.

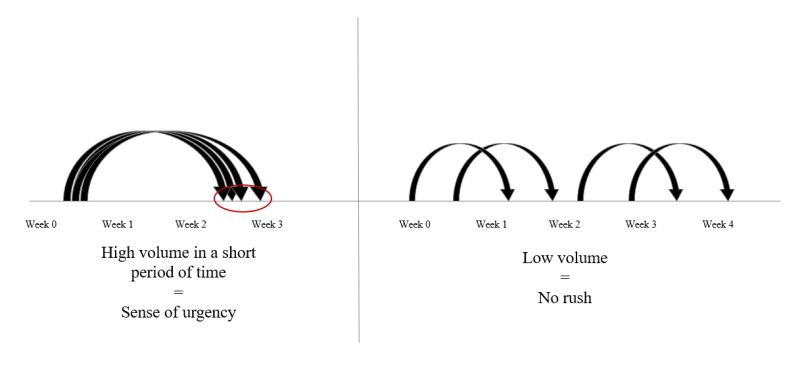

Therefore, in order to make your story great, and build authority you need to concentrate all the investor meetings in a short period of time, so you can signal investors that many other investors are also looking at the round:

How can you build density of meetings? Use the following system and be disciplined:

1. Target a batch of investors you can manage (between 10 and 25) to try to get a warm intro.

2. Kick-off that batch of investors by aiming to maintain all the meetings in the same 1-2 weeks period.

3. Use the progress of their Due Diligence to push the others to a final response.

4. If all of them pass, go back to step 1.

Momentum is what forces them to take action.

How to get warm intros with your target VCs

As we mentioned before, the best playbook to get investors’ attention is to reach out to founders of their portfolio.

1. Sign in to your EasyVC account using your login credentials.

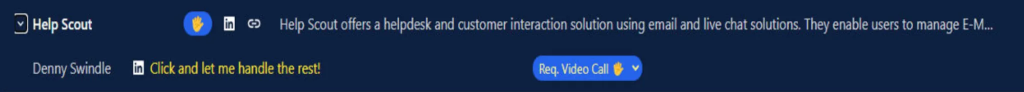

2. Head over to the Get Introduced 🍋 section for your target investor in EasyVC:

Here the AI will assess all of the portfolio companies of that investor and automatically mark the startups you should be connecting with with a lemon 🍋.

3. Click on the founder’s LinkedIn icon to open their LinkedIn profile on a separate tab, and then click on ‘Copy Template’.

Side note: The template can be found under ‘LinkedIn Templates’ (last section) and contains metatags that will automatically be populated. You can modify the text as you wish, but make sure the [Founder] and [Investor] metatags remain intact.

4. Before sending a connection request to the founder on LinkedIn, click on Add a Note and copy and paste the template. Then click Send.

Want to do this process even faster? Try our Chrome Extension.

Instead of copying, pasting the template and sending connection requests manually, do this instead.

👉 Add the EasyVC Chrome extension to your browser to automate the process of sending connection requests to portfolio founders.

Rather than a ‘Copy Template’ button, click on the LinkedIn icon and the whole process of opening the LinkedIn profile, copying & pasting the message, and sending the connection request, will be done automatically.

Why is this Playbook important for you as a founder

Reaching out to investors through warm intros campaigns will build authority around your company and your funding round.

These are some quotes from Venture Capital investors I’ve heard throughout the years that can help you better understand why this is an important playbook:

“I don’t even go to pitching events. If the founder needs to go to pitching events, it means either investors are not fighting for this founder, or the founder is not having enough traction in the round or the founder doesn’t know how to fundraise”

“I only jump on a call with a founder when I get 2 warm intros”

Knowing this, you as a founder need to know that breaking into the right circles is not only relevat for your round, it is also an important test for investors. The hard truth about this process is that, to be taken seriously and really grab investors’ attention, a warm intro is essential. As Marc Andreessen says in the video “The argument in favor of the warm intro is that it’s the first test of your ability to basically network your way to the investor”. If you think about it, if you can’t get an intro with a VC, how are you going to close massive deals, bring influencers onboard or present your solution at boards of public companies?

This is the strategy I used to speak with all top funds in Europe and the US I had on my target list.

You don’t need to spend thousands of dollars on flights to go to startup events worldwide to try to connect with investors. Just focus on LinkedIn and reach out to other founders.

Now it’s time for you to nail your funding round.