Early Stage Startup Funding: Using AI to Find Early Stage Investors

Use the power of AI to do all the heavy lifting of profiling and contacting investors. We ourselves have foundraised for our previous companies and we know how hard it is to fundraise while you build your business. But don’t worry, now you can use AI as your fundraising assistant thanks to EasyVC.

Introduction: Early Stage Startup Funding

Starting a new business is an exciting journey, but it often requires significant capital to get off the ground. This is where early stage startup funding comes into play. In this guide, we’ll explore the various avenues available for securing initial investments, helping you navigate this crucial phase with confidence. Early stage funding is the lifeblood of a startup. It provides the necessary resources to develop your product, hire key team members, and launch your marketing efforts. Without it, even the most brilliant ideas can struggle to come to fruition. For more insights, check out our comprehensive guide for founders.

The Different Stages of Startup Funding

Understanding the different stages of startup funding is essential for any founder. These stages include:

- Seed Funding: The initial capital used to start the business.

- Series A: Funding to scale the product and grow the user base.

- Series B and beyond: Funds to further scale and expand the business.

Sources of Early Stage Startup Funding

There are several sources from which you can secure early stage funding. Each has its own advantages and challenges.

Bootstrapping

Bootstrapping involves using your own savings or revenue generated by the business to fund your startup. This method allows you to maintain full control but can be risky if your personal finances are limited. Learn more about bootstrapping in our comprehensive guide.

Friends and Family

Many founders turn to friends and family for initial funding. While this can be a quick way to raise money, it’s important to approach these investments professionally to avoid straining personal relationships.

Angel Investors

Angel investors are individuals who provide capital in exchange for equity. They often offer valuable mentorship and industry connections in addition to funding.

Venture Capital

Venture capital firms invest in startups with high growth potential in exchange for equity. This source of funding can provide significant capital but often comes with the expectation of rapid growth and a clear exit strategy. Understand the differences between venture capital and private equity to make informed decisions.

Grants and Competitions

Various organizations offer grants and hold competitions to support innovative startups. These funds don’t require equity but can be highly competitive.

Innovative Tools for Finding Investors

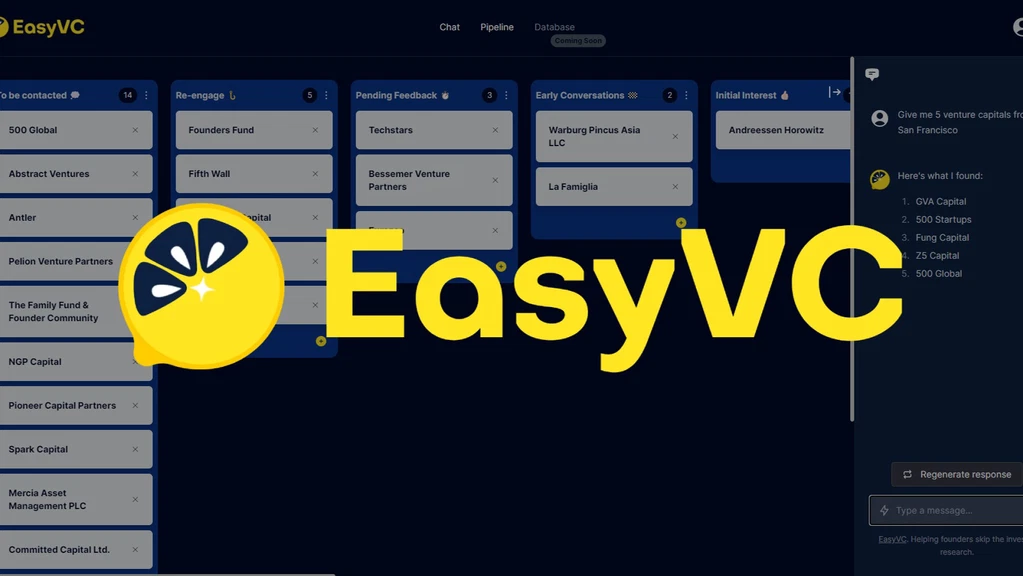

Navigating the early stage funding landscape can be challenging, but tools like EasyVC can make the process more manageable. EasyVC leverages artificial intelligence to help founders find the right investors, fast-tracking the funding process. Discover how EasyVC can transform your fundraising journey.

What is EasyVC?

EasyVC is an AI-trained chatbot equipped with over 50,000 contacts in Venture Capital and Business Angels, actively updating its database with the latest information from 2022 and 2023. Unlike traditional, unwieldy databases, EasyVC offers a streamlined, user-friendly experience, pinpointing the best investors for your startup.

How EasyVC Can Help You

With EasyVC, you skip the arduous investor research process. This AI companion identifies potential investors for you, providing you with a curated list of contacts. Each investor card includes details on portfolio founders who have been invested in by the investor, along with their contact information, facilitating warm introductions.

Warm Intros: The Key to Effective Networking

One of the most effective ways to raise capital and get investors’ attention is through warm introductions from other founders. EasyVC makes this process seamless by offering a pipeline of portfolio founders who can introduce you to potential investors, enhancing your credibility and increasing your chances of securing funding. For more strategies, read about how to find investors for your business.

Preparing for Early Stage Funding

Before approaching potential investors, it’s crucial to be well-prepared. Here are some key steps to take:

Develop a Solid Business Plan

Your business plan should outline your vision, target market, revenue model, and growth strategy. It serves as a roadmap for your startup and a tool to convince investors of your potential. Master the art of business planning with insights from Mastering Your Round of Funding.

Create a Compelling Pitch Deck

A pitch deck is a presentation that provides an overview of your business. It should be clear, concise, and visually appealing. Highlight the problem you’re solving, your unique solution, market opportunity, and team. For inspiration, explore 40 pitch deck examples and the best seed pitch decks that raised significant funds.

Build a Minimum Viable Product (MVP)

An MVP is a simplified version of your product that demonstrates its core functionality. It allows you to gather user feedback and show investors that your idea is viable.

Network and Build Relationships

Building relationships with potential investors and industry experts can open doors to funding opportunities. Attend industry events, join startup incubators, and leverage online platforms like LinkedIn. Our Ultimate Guide to Startup Incubators can help you understand how they can propel your business forward.

Conclusion: Navigating the Early Funding Landscape

Securing early stage startup funding is a critical step in bringing your business idea to life. By understanding the different funding sources and preparing thoroughly, you can increase your chances of success. Remember, persistence and resilience are key. Keep refining your pitch, building your network, and learning from feedback.

Stay tuned for our next post, where we’ll dive deeper into creating a winning pitch deck that captures investors’ attention. With resources like EasyVC at your disposal, navigating the funding landscape has never been easier.